As tokenization takes root globally, Luxembourg has passed a new law aimed at making the issuance of digital securities easier, cheaper and more efficient.

Parliament of Luxembourg recently approved Blockchain Law 4, the country’s latest attempt to facilitate blockchain adoption. It is the fourth in a series of blockchain laws; the first was already implemented in 2019. The latest framework provides a simplified regime for the “issuance, registration and transfer of ownership of dematerialized debt and equity securities using DLT (distributed ledger technology).”

Luxembourg for Finance, the country’s financial development agency, says the new law will cement the country’s “pioneering role within the EU in the use of DLT technology, particularly in the area of dematerialized securities issuance.”

Dematerialized securities exist only electronically and are registered in a central depository system, such as stocks, bonds and exchange-traded funds (ETFs).

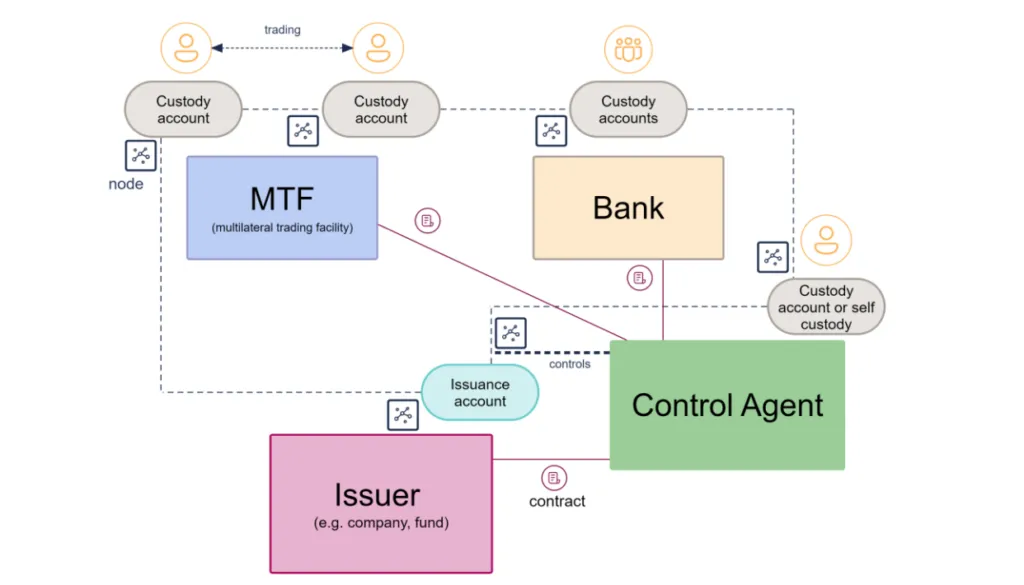

The prominent provision of the new law is the introduction of a control agent whose purpose is to reduce inefficiencies and simplify tokenized debt and securities issues treat. Previously, issuance required a central account holder (which in other markets would be a central securities depository or CSD), which are highly regulated financial entities, making the process more expensive and limited. Then there would be a separate guardian creating a two tier system.

However, with control agents, the process will be easier for the participants as credit institutions, investment firms, banks and settlement organizations can now play this role. Passported EU companies licensed in other EU states can also play this role, further broadening the scope; this differs from other EU members which require localized operations.

A control agent will maintain the issuance of tokenized securities, monitor the chain of custody of these securities and ensure reconciliation between the issuance account on DLT and the securities account. Essentially, rather than having two separate companies handling issuance and custody, one control agent can handle both, eliminating the two-tier system.

The new law simplifies the requirements for control agents, making it easy for most financial firms to apply for the role. To qualify, a firm must notify the Financial Markets Regulator at least two months in advance and meet all regulatory requirements, such as governance, security, organizational structure and internal controls.

In recent years, Luxembourg has been quietly evolving its financial laws to accommodate blockchain. In 2023 it was over Blockchain Law IIIwhich allowed electronic DLT to be used as collateral for financial instruments held in securities accounts.

With tokenization taking root and ambitious projections of the technology unlocking 15 trillion dollars in the next decadeLuxembourg is moving ahead of other advanced EU economies, which could make it the biggest winner in Europe. Regional frameworks such as Markets in Crypto-Assets (MiCA), which continue to unify the bloc’s regulatory approach, mean that companies can establish themselves in Luxembourg and then use an EU passport to serve the rest of the region. Latvia is another small nation that has quickly realized the potential of a post-MiCA world and is busy working with business using blockchain to set up in the country.

Watch: How blockchain technology can help reduce costs for businesses