Key dealers

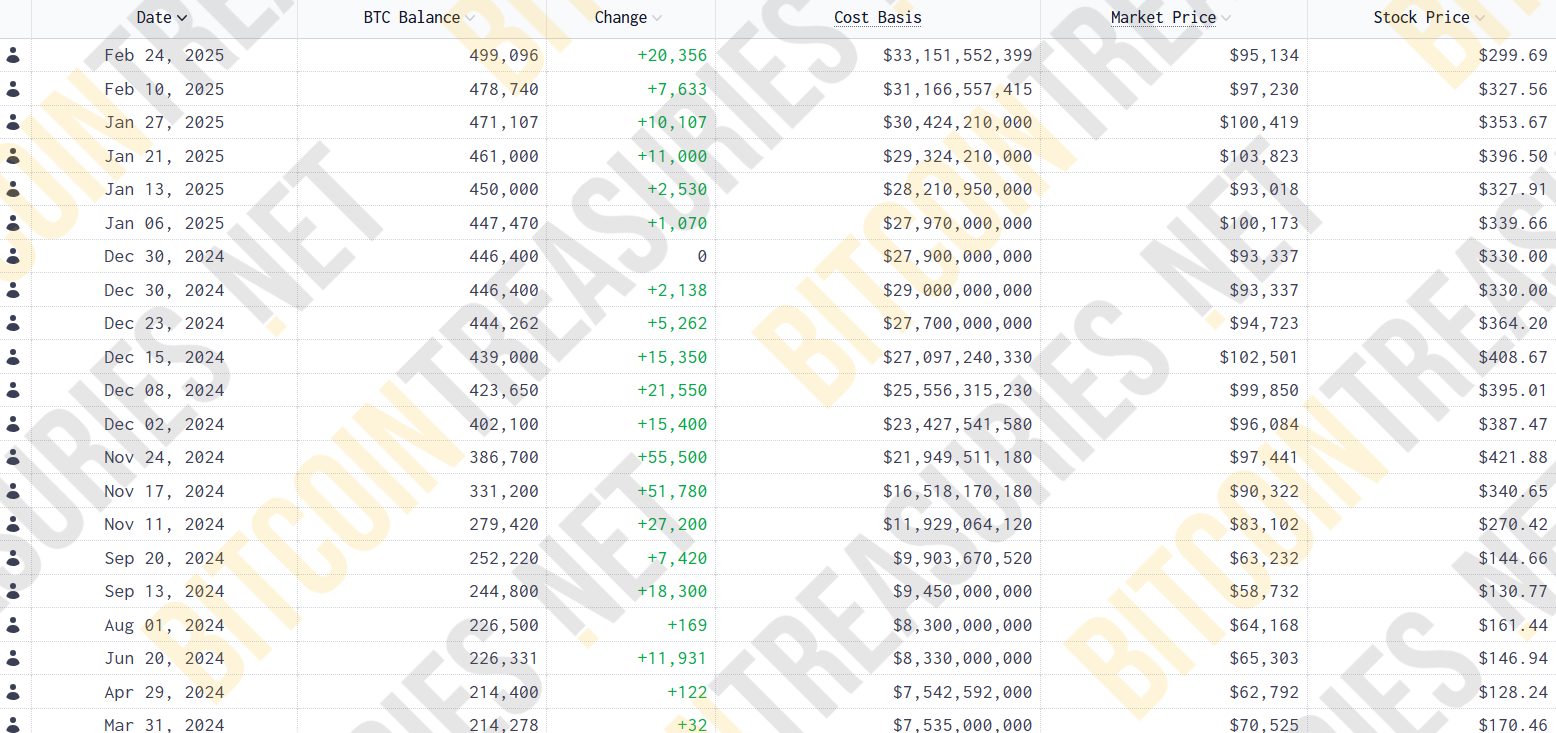

- Strategy scooped 130 Bitcoin during the week which ended March 16.

- The acquisition was financed by selling A -pre -embedded shares in Serie A, which generated $ 10.7 million in the net profit.

Business Intelligence Firm Strategy, formerly known as Micro Strategy, said it had today acquired $ 130 Bitcoin for $ 10.7 million at an average price of $ 82,981 per coin between March 10 and March 16.

The company resumed bitcoin acquisition after a two-week break after buy Made of the week that ended February 23. Last week’s acquisition was the smallest since April, according to data from bitcoin treasuries.

According to the latest strategy disclosure With the SEC, the acquisition of revenue from the sale of 123,000 shares in the strategy’s 8.00% series A Eternal strike -leased shares (STRK shares) was financed, which generated approximately $ 10.7 million in the net profit. The company confirmed that no ordinary share in Class A was sold during the same period.

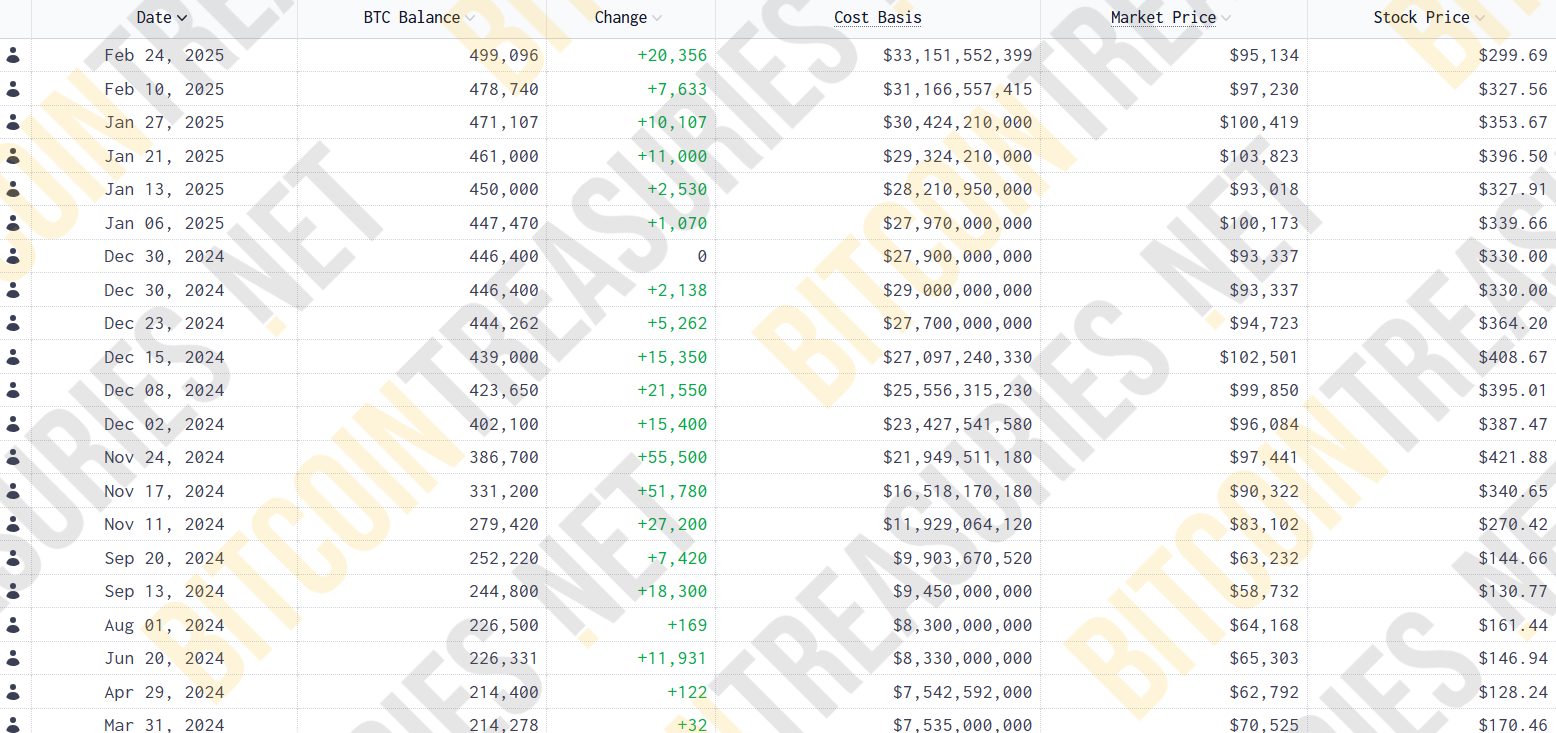

The company’s total Bitcoin holding is now at 499 226 BTC, valued at over $ 41.6 billion. Strategy co -founder and executive chairman Michael Saylor said that the company’s total holding was purchased at an average price of $ 66,360 per BTC, including fees and expenses. The company currently has more than 2% of Bitcoin a total of 21 million supply.

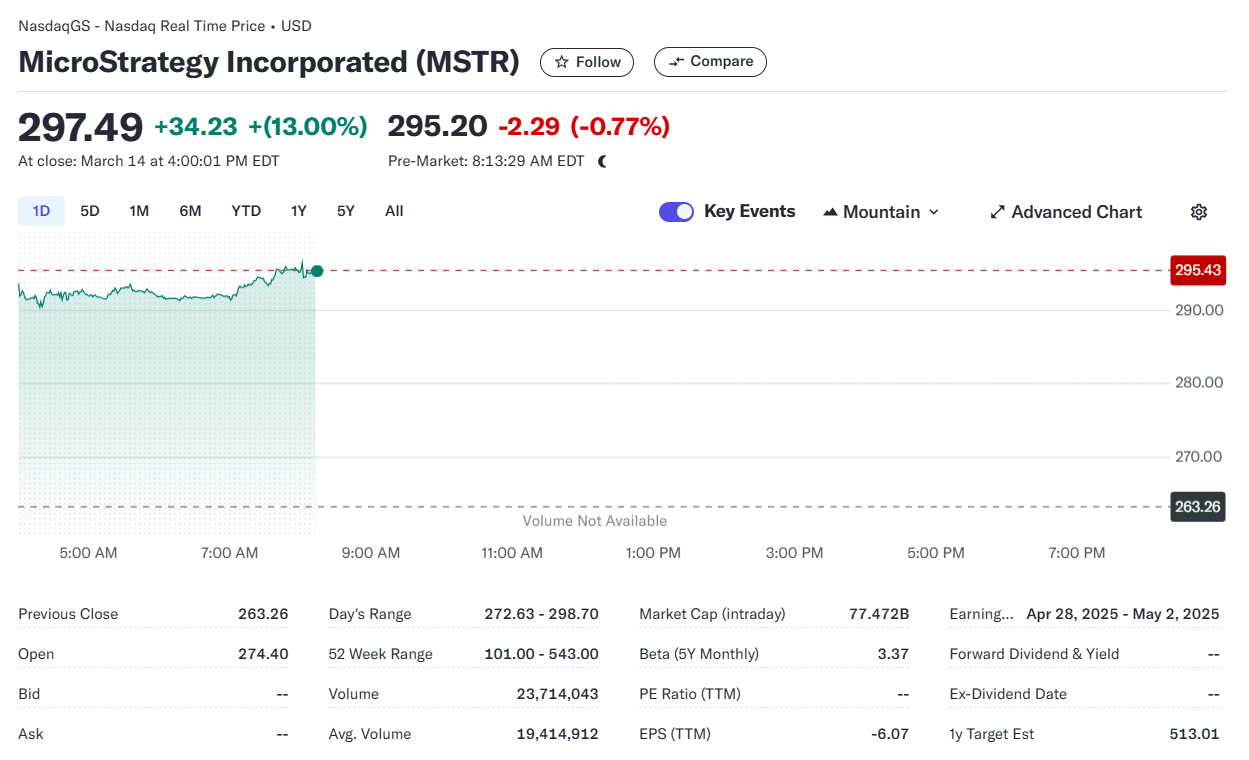

The company’s shares (MRST) closed up 13% to about $ 297 after receiving more than 77% over the past year, according to Yahoo Finance data. The share is traded slightly lower in trade before the market today.