The analysis company Santiment on the chain has revealed how the majority of Altcoins are currently in what has historically been a purchase zone.

Half -time trade return is extremely negative for most altcoins

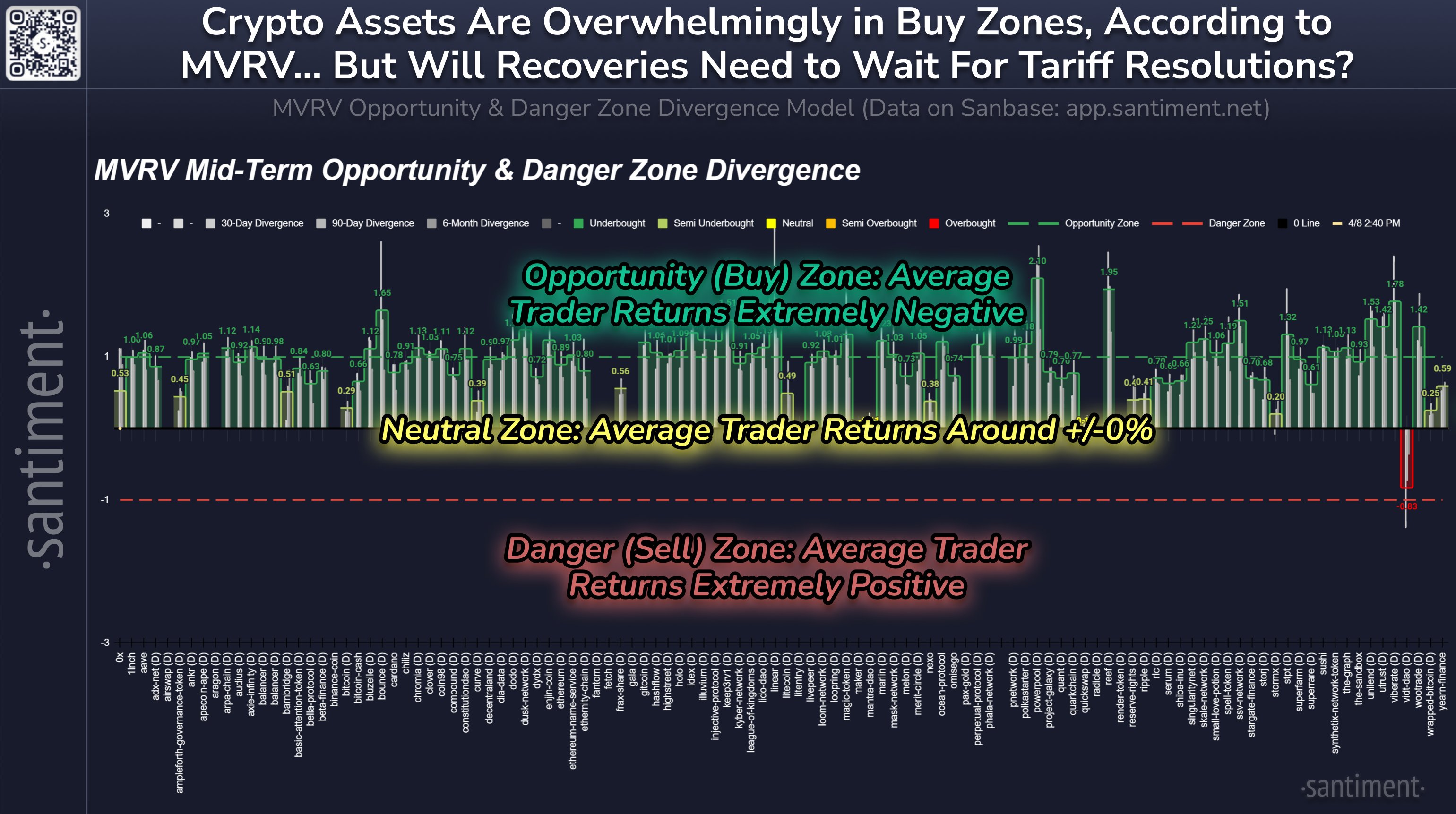

In a new one post At X, Santiment has shared an update for its MVRV option and divergence model for the various altcoins in the sector. The model is based on the popular ”Market Value to Realized Value (MVRV) relationship. “

The MVRV relationship is an indicator of the chain that basically tells about investors in a cryptocurrency as a whole keeps their coins with a net gain or loss.

When the value of this metric is greater than 1, it means that the average investor has a profit. On the other hand, it suggests during this threshold dominance of loss.

Historically, the proprietor’s profitability is something that has had an impact on the prices of digital assets. When investors are in big profits, they can be tempted to sell their coins to realize the stacked profits. This can hinder haussearted speed and result in a top for the price.

Similarly, holders who are significantly underwater results in market conditions where profit has stopped, which allows Cryptocurrency to reach a bottom.

Santiment MVRV Opportunity and Farzondiverrgence model Take advantage of these facts to define purchases and sell zones for altcoins. The model calculates the divergence for the MVRV ratio at different time frames (30 days, 90 days and 6 months) to find whether an asset is in one of these zones or not.

Here is the diagram shared by the analysis company that shows what the various altcoins currently look like based on this model:

Looks like most of the sector is currently in the buy region | Source: Santiment on X

In this model, a value that is greater than zero suggests that the average trader is negative for that time frame and that below it is positive. This is the opposite orientation of how it is in the MVRV relationship, with the zero level that takes the role of the 1 mark from the indicator.

From the graph it is visible that almost all altcoins have their MVRV Diver’s larger than zero on the different time frames. Of these, most of them have their half-time MVRV Diver’s greater than 1. The opportunity zone mentioned earlier is beyond this mark, so the model currently shows a buy signal for the majority of altcoins.

The average negative return has come for these coins because the market has been in concern after the news related to Customs. Although the model may show a purchase signal for altcoins, it is possible that this uncertainty will continue to haunt the market. As Santiment explains,

However, if a global customs solution is reached, it would undoubtedly trigger a very rapid recovery of Cryptocurrency, “notes that this is currently a very large” IF “based on the latest media coverage on what is quickly called a full” trade war “between the United States and the majority of the world.

BTC price

At the time of writing, Bitcoin flows around $ 76 900, down more than 9% in the last seven days.

The price of the coin has already erased its attempt at recovery | Source: BTCUSDT on TradingView

Image from Dall-E, Santiment.net, diagram from tradingview.com

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.