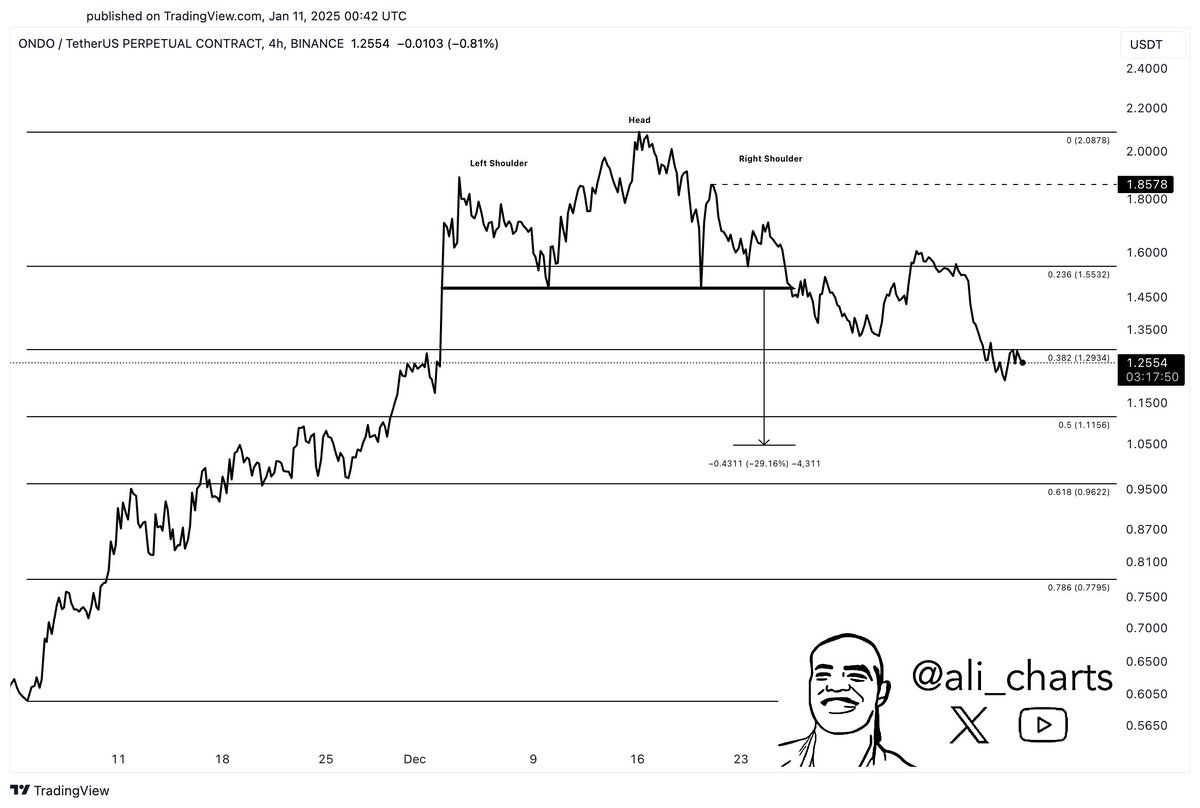

- If the head-and-shoulders pattern dominates ONDO, an additional 17% cases can be seen

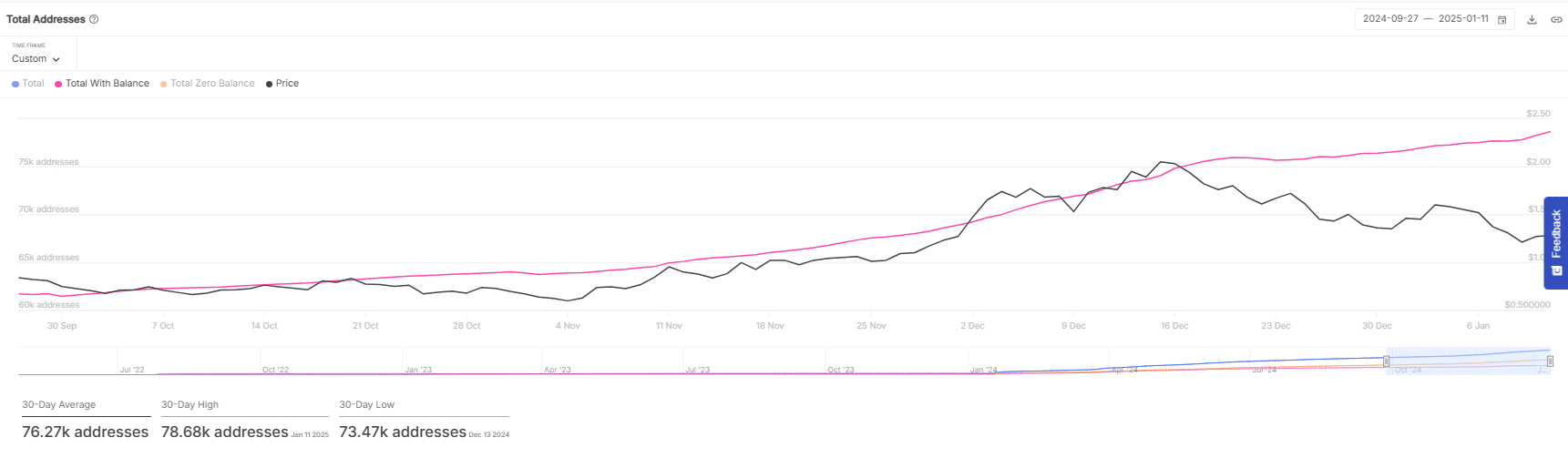

- ONDO’s total addresses with balance over time reflected a steady increase

ONDO’s price action formed a head-and-shoulders pattern on the 4-hour period. The left shoulder peaked near $1.85, the head at $2.09, and the right shoulder failed to surpass $1.85, confirming the bearish formation.

This led to a break below the $1.55 neckline and this could confirm the expected 29% decline towards the $1.15 Fibonacci retracement level.

If the bearish pattern persists, a further decline of 17% could push ONDO towards $1.05, which is in line with the 0.618 Fibonacci level. The price level of $1.05 could be a suitable buy level as it is among the best RWA projects with the potential for profits.

Conversely, a retracement of $1.55 as support could invalidate the bearish outlook and trigger a potential rally towards $1.85. This reversal would likely attract buyers, potentially targeting the $2.09 resistance zone.

Price respected previous Fibonacci levels, indicating that traders are following technical setups. Both results were highly dependent on momentum and broader market conditions, emphasizing the pattern’s crucial role in ONDO’s next move.

ONDO on-chain analysis shows…

Tracking ONDO’s total balance sheet addresses over time reflected a steady increase, signaling growing holder confidence despite a volatile price trajectory. This pointed to an accumulation trend, even as the price faces declines on the chart.

Historically, an increase in addresses with balance has often preceded stability or increases in ONDO’s price – indicating a potential buffer against the threatened 17% drop.

If the trend continues, ONDO may stabilize or recover faster than expected. Conversely, if addresses with balance were to decline sharply, it could exacerbate the price drop, confirming the bearish forecast.

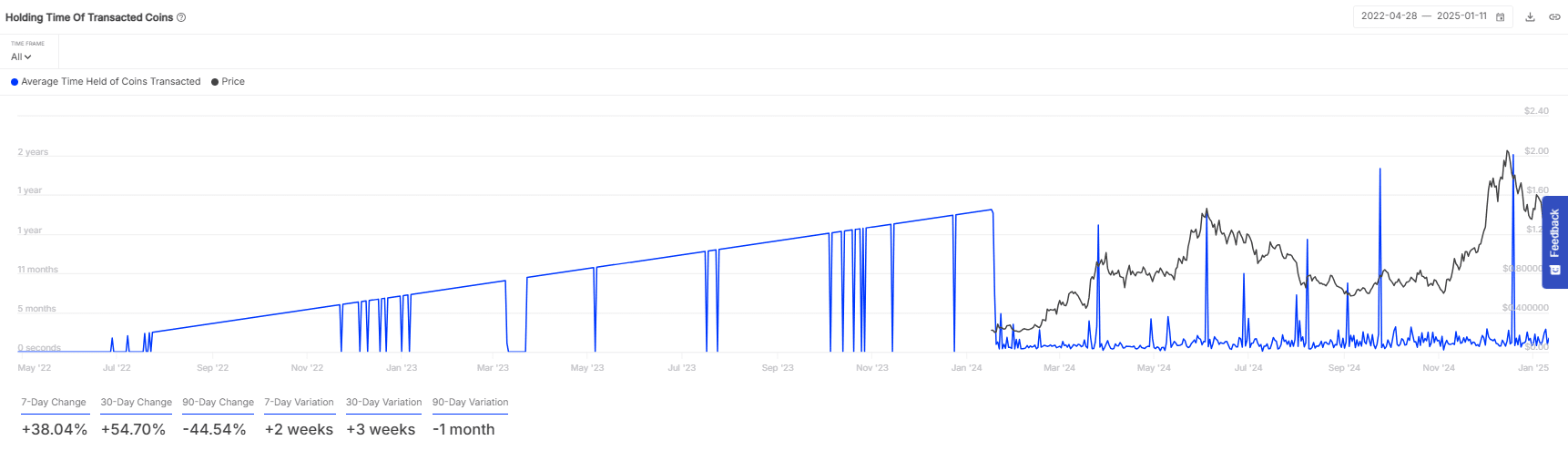

In addition, the average holding time of ONDO transactions indicated fluctuating investor behavior against the backdrop of price movements. The peaks in holding time from mid-2023 to 2024 coincided with periods of price stability or increases.

However, the marked shortening of holding times towards the end of 2024 appeared to be consistent with periods of falling prices – indicating an increase in selling pressure.

This recent trend of reduced holding times may signal increased risk of further price declines. If historical patterns hold, longer periods of shorter average holding times often precede price falls.

Conversely, an increase in holding times could indicate the potential for price stabilization or recovery, which is crucial to offsetting the expected 17% decline.

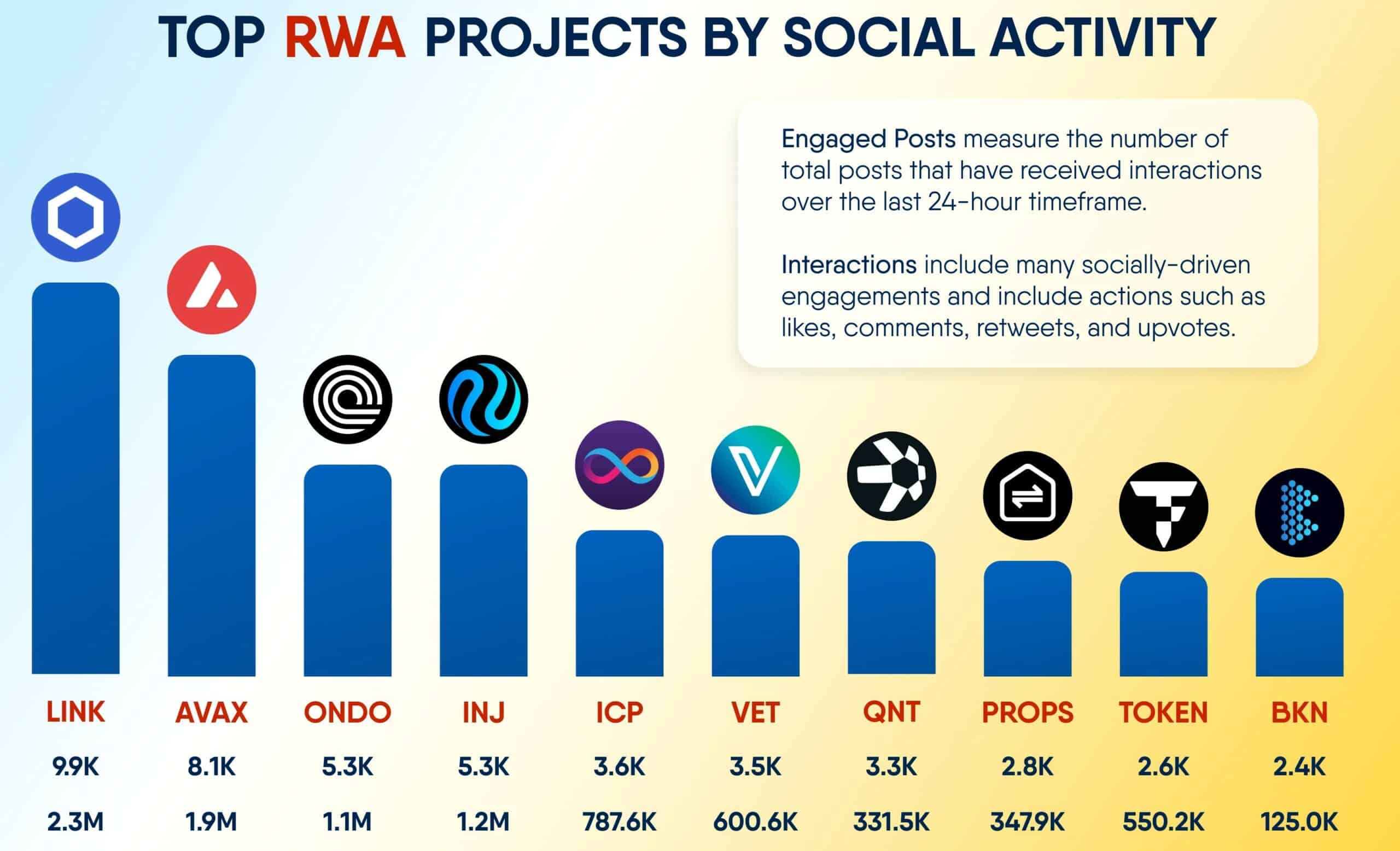

Social activity

ONDO remains a top contender and safely holds the third position with engaged posts at 5.3k and interactions at 1.1 million.

The social pull for ONDOdespite potential price falls, it could allude to resilience and continued investor interest, potentially stabilizing or even reversing the projected 17% price drop.

This enduring social presence can signal underlying strength, making ONDO a critical bell in the changing crypto landscape.