Ethereum has struggled to recover the land of $ 2,800 as support, leaving investors uncertain about the short -term direction for their price. The second largest cryptocurrency has not been able to start a recovery rally, with analysts that increasingly require a baisse -like continuation. The negative feeling has been driven by Ethereum’s overwhelming performance compared to market expectations, which keeps the price range bound below key supply levels.

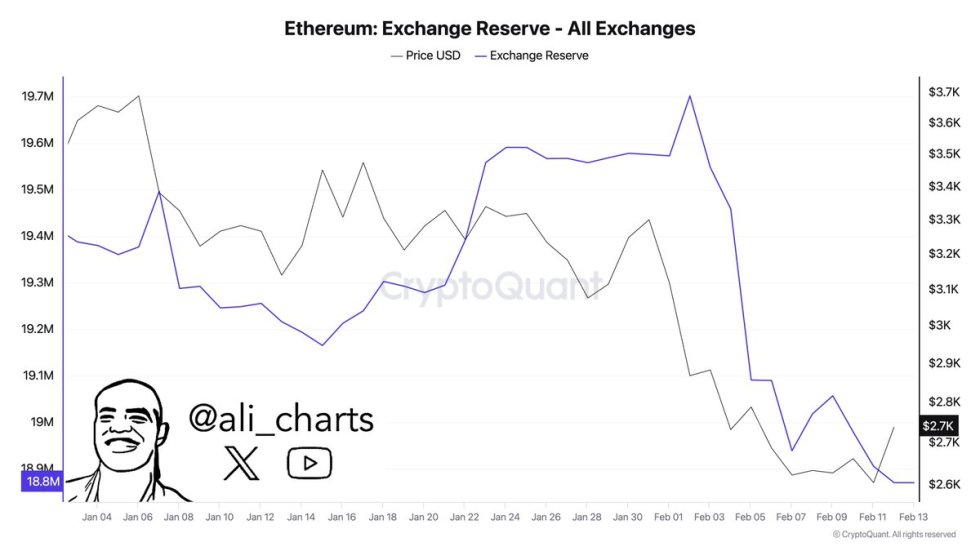

Despite pessimism, some investors will remain hopeful that Ethereum may soon enter a recovery phase. A potential recovery can emerge when the market begins to find stability. Addition to optimism shared top analysts Ali Martinez’s key measurements that revealed a significant development: more than 900,000 Ethereum has been withdrawn from exchanges over the past ten days. This trend signals increased the accumulation of larger players and reduced sales pressure, which indicates that investors can prepare for a potential rally.

The significant withdrawal of ETH from exchanges may indicate to grow Trust among long -term holdersEven in the midst of short -term price fights. As ETH continues to consolidate under the $ 2,800 mark, the next few days will be crucial to determine if it can reverse its baisse -like trend or meet the longer disadvantage. Investors look closely to see if ETH can turn the tide and regain higher levels.

Ethereum Metrics Signal Stong Accumulation

Ethereum struggles with significant volatility when consolidated under the $ 2,800 mark, a crucial level that bulls need to recover to initiate a recovery rally. Sentiment on the market remains divided, with retail investors that fear additional disadvantages, while some analysts predict an aggressive collection in the coming months. Ethereum seems to be in an important phase in this cycle and is struggling to gain momentum like Bitcoin, which has shown relative strength.

Martinez has Shared key data Sledge light on Ethereum’s current dynamics. Over the past ten days, more than 900,000 Ethereum has been withdrawn from exchanges, signaling increased accumulation of major players and reduced sales pressure. This trend suggests that institutional and long -term investors can prepare for a potential upward movement, even when retail participants become more cautious.

The last few weeks have been challenging for Ethereum holders. Last week’s dramatic sales saw ETH sink from $ 3,150 to $ 2,150 in less than two days. While the price has since recovered to $ 2,600 $ 2,700 interval, ETH has struggled to break through important delivery levels and regain the foot over $ 2,800.

When Ethereum consolidates at current levels, the next few days will be critical. If the Bulls manage to recover the ground at $ 2,800 and drive higher, it can signal the beginning of a new haus phase. Conversely, failure to break over these levels can result in prolonged consolidation or even longer disadvantage, which increases the uncertainty. Both investors and analysts look carefully at the market and are waiting to see if Ethereum can break away from its baisse -like grip and map a path to recovery.

Price testing level

Ethereum is traded at $ 2,720 after days with lateral trade and determination. The market seems stuck in a phase of speculation, with the feeling sharply divided when it comes to short -term price direction. Investors are waiting for a clear signal as ETH consolidates below critical resistance levels.

In order for Ethereum to confirm a recovery tour, bulls must recover the $ 2,800 brand as support and squeeze the price over the psychological level of $ 3,000. Breaking through these levels would signal Haussearted Momentum and set the stage for a rally against higher delivery zones. The level of $ 3,000 also corresponds to 200-day sliding average, a key indicator on long-term trend direction. A long -lasting move above this level would give renewed optimism to the market.

However, the risk of further disadvantage remains. If Ethereum fails to regain the level of $ 2,800, the price may return to to lower demand around $ 2500. This scenario would probably strengthen baisse -like feelings and extend the current uncertainty period. With the feeling divided and the wider crypto market showing mixed signals, Ethereum’s next move is likely to set the tone for its performance in the coming weeks. Both bulls and bears look at the $ 2,800 brand as a critical bending point for the second largest cryptocurrency.

Featured Image from Dall-E, Chart from Tradingview