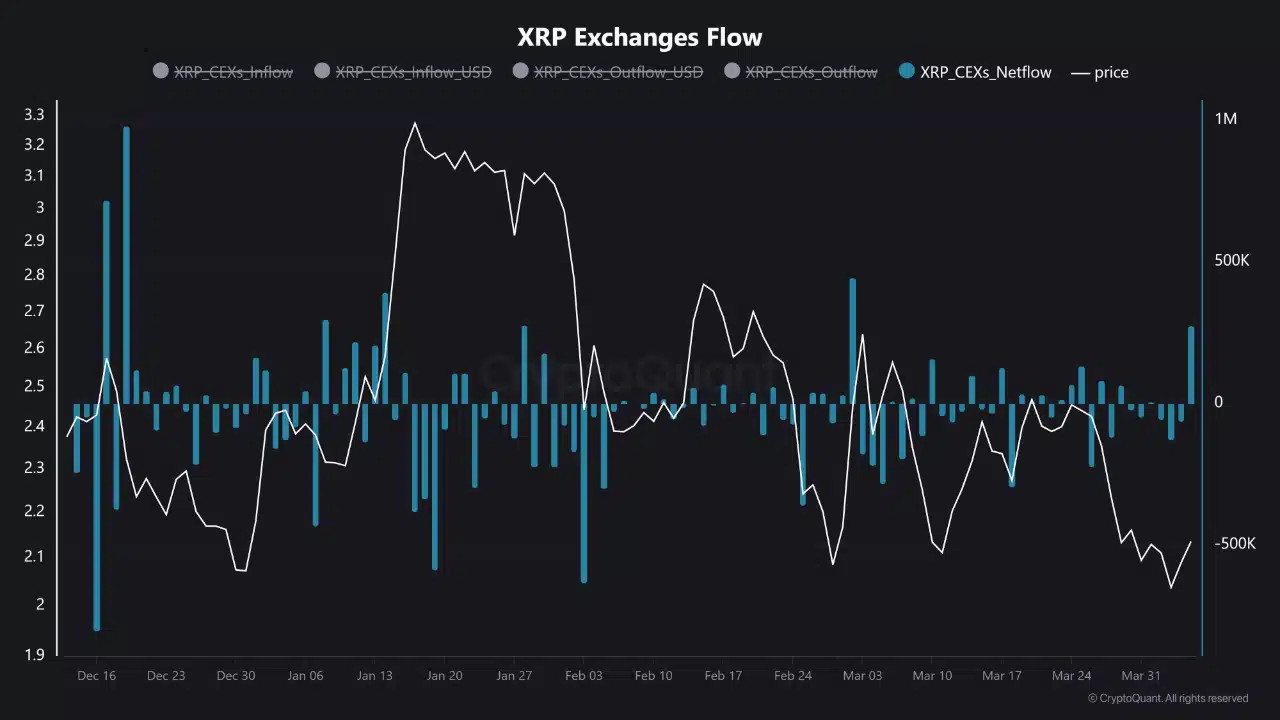

- XRP saw a sharp inflow of 275,000 tokens in the middle of Bitcoin’s sideways and signaled cautious investors’ feel.

- Increased XRP exchange deposits suggested potential sales pressure, with traders waiting for Bitcoin next move.

Ripple (xrp) Just made a quiet entrance to centralized exchanges and released over 275,000 symbols.

While Bitcoin continues its lateral movement, XRP’s sudden force resembles a moment of restlessness on the market – such as controlling a phone during a dull conversation.

If Bitcoin remains captured in this stagnation and does not regain speed, XRP’s feature can signal an impending displacement over the wider crypto landscape.

XRP’s big move is not random

XRP’s sudden 275,000 token net inflow On April 5, it’s not just noise – it’s perfectly timed with Bitcoin’s price that stays under the key resistance.

Historically, such inflows during periods of market uncertainty often suggest risk-off-investors from investors.

Bitcoin’s Sideways Grind has left Altcoin’s vulnerable and XRP Seems to be the first to flash.

If this marks the beginning of a broader risk rotation, we could see that more alts are following in the coming days. The time is not lost on Market Watkers – this is a classic hedging behavior when the confidence beckons in BTC’s next move.

Caution but not panic … not yet

When investors move XRP to exchanges, it is not a distance to say that the feeling has cooled.

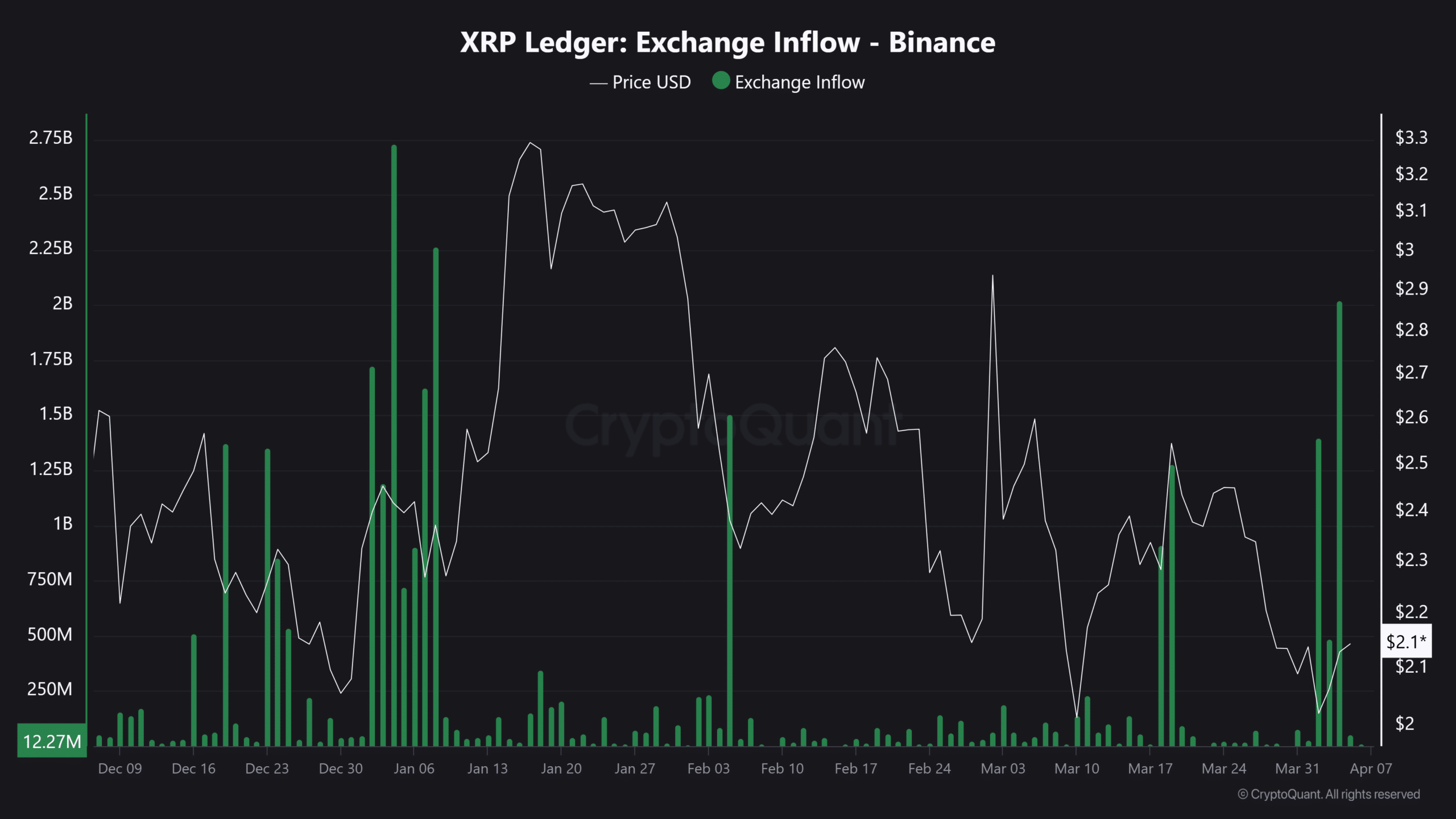

Cryptoquant data reveals that April’s inflow is the largest in weeks, which occurs when the overall Altcoin moment decreases. Bitcoin’s inability to surpass the $ 74K mark – historically a pressure point for secondary tokens – can affect the behavior of nutrition.

In addition, rumors of regulatory draw on crypto trade in South Korea have emerged in April. These rumors can get a cautious attitude among Asian XRP holders.

While XRP does not experience a crash, the marketing entry has been shifted from Hausse optimism to a more cautious, wait-and-see strategy.

What is the next one coming?

XRP’s net inflow patterns often signal upcoming sales, although impact is not always immediate. Data shows that last time inflows reached this level, at the end of January prices fell within a few days.

The most important takeaway is that liquidity is collected on exchanges, which usually indicates that supply is prepared to meet demand – if demand is materialized.

Without a significant Bitcoin outbreak to restore market confidence, XRP can face increased short-term sales pressure. But if buyers enter, this installation may prove to be a false one.

In any case, capital is on the road and tracks near Bitcoin the next action.