- Stablecoin market increased over $ 230 billion, with Rlusd that gained momentum as a remarkable challenger

- Rights clarity and institutional interest have also driven Stablecoin growth

The Stablecoin The sector is entering a phase of renewed speed right now, a formed of both regulatory pressure and a visible at the top of institutional confidence. While established giants like USDT and USDC have maintained their dominance, new participants are silent to cut out a meaningful space on the market.

Such a name has begun to turn your head – Ripples Rlusd. Against a background of legislative opportunities and a change in US policies, the broader Stablecoin ecosystem begins to look like one of Crypto’s most resilient growth stories.

Stablecoin Market sees renewed capital inflows

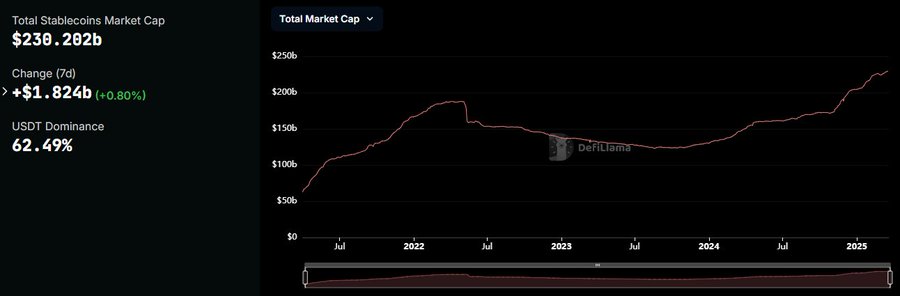

The Total market case For Stablecoins, officially increased over $ 230 billion recently and marked a strong return to growth after a long -term calm.

This represented an increase of 56% from year to year. This hike also followed a new interest from institutional actors such as redistributed capital against Dollar-peeled assets.

Especially the USDT dominance was strong of over 62%, although there were signs of mild diversification when new players gained traction. The latest upset reflected a broader risk-on-feeling over digital assets. However, Stablecoin’s stability and liquidity make them a favored entry point.

The sector saw a net inflow of $ 1.8 billion last week, which emphasized the demand for reliable crypto-in-born dollars among geopolitical and financial uncertainty.

Ripples rlusd gains momentum

Ripples Rlusd Stablecoin, Launched to compete in the dollar backed token market, quickly finds its foot. The token’s circulating supply reached $ 160 million in mid -March.

What stands out is RLUSD’s increasing adoption of Ethereum -Mainnet -a strategic movement that signals Ripple’s intention to bridge both institutional and defi markets. From January to March 2025, RLUSD has been steady, with noticeable nails in line with periods of market vollatility.

This suggested that Rlusd is used for liquidity and hedging purposes.

Although it is still a fraction of USDT or USDC, RLUSD’s momentum is worth noting, especially considering Ripple’s established infrastructure and recently regulating profits in the United States and the United Kingdom

If growth continues at this rate, Rlusd can become a top-five Stablecoin at the end of the year.

Policy Momentum, not immediate market action

The surplus in Stablecoin market value – now over $ 230 billion – is rooted in more than just investors appetite. It is increasingly linked to policy signals. On March 20, President Donald Trump treated the digital asset meeting with a clear call to Congress to pass “Simple, Rules for common sense for stablecoins And market structure. “He placed Stablecoins as a strategic pillar to strengthen Dollartominan’s globally and urged rapid legislation to prevent them from losing the ground to competitors like China.

Although no major institutional players have revealed new offers as a direct response to the speech, messages have deepened the market’s conviction. Regulatory Clarity – once shady – takes shape, and it only drives optimism.

If these legislative intentions are materialized, the rippling effects on emission, adoption and innovation may be far -reaching. At the moment the tone from the top is Hausse and the market is listening.