- XRP Futures ETF debuts strongly by almost $ 6 million in the first day’s trade volume.

- Spot XRP ETF approval gains momentum despite the Sec delay and ongoing legal obstacles.

Ripple (xrp) attracts renewed institutional interest after its legislative wind finally ended after four years.

On May 19, the CME group launched its XRP -Futures ETF and registered an impressive daily trading volume of almost $ 6 million on debut.

CME’s XRP ETFS surpasses ETFS?

With that said, the recently launched XRP ETFs have quickly surpassed Ethereum (ETH) Futures ETFs in performance, signal robust institutional interest.

If this step continues, XRP may challenge Bitcoin (BTC) Futures etfs. However, reaching that level remains ambitious. BTC ETFS regularly sees trade volumes in billions.

The early success of the XRP products is still strengthening the case for future Spot ETF approvals.

Riding this institutional wave has seen XRP a significant price collection. The jumped 1.33% to $ 2.33, with open interest rate to $ 4.69 billion at press time.

Day one of the trade – details

CME group data reveal That XRP -futures had a strong debut. On the launch day, four standard contracts were traded, each represented 50,000 XRP. This accounted for about $ 480,000 in nominal volume at an average price of $ 2.40.

Most of the activity came from 106 micro contracts, each cover 2500 XRP. Together, they contributed over $ 1 million in additional volume.

This trading pattern indicates that large players enter the market. At the same time, less institutional participants are actively involved with XRP futures from the beginning.

Despite the SEC that delays its decision on several crypto -etfs, including those bound to XRP and Solana (sun)Momentum around XRP investment vehicles continues to grow.

ETF Great President comments Spot XRP ETF

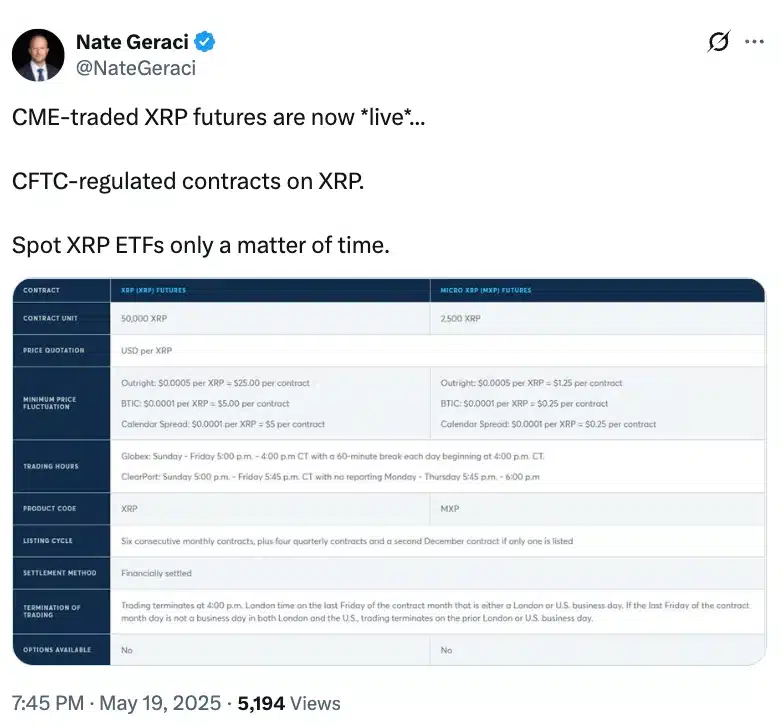

Nate Geraci, who points out the same, emphasized Nate Geraci recently on X (formerly Twitter) that Location XRP ETFs are inevitable.

This highlights the importance of CME’s Live, CFTC-regulated XRP-Future agreement.

In fact emotion on decentralized prediction platform Poly market also remains optimistic, with an 83% probability priced for possible approval.

But with Franklin Templeton’s application now pushed On June 17, the coming weeks may prove to be crucial to design the next phase of institutional access to XRP.