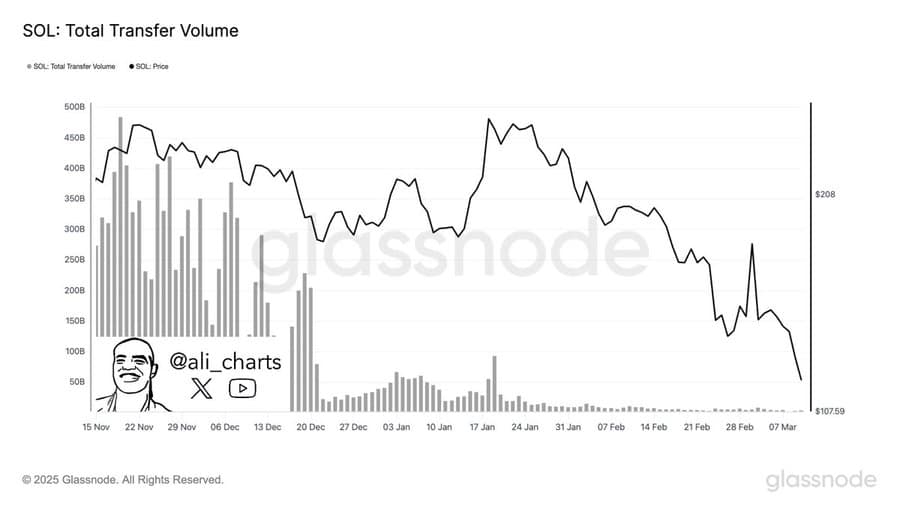

- Soana has seen a significant decline in trading volume, with the same case to its lowest level 2024

- On the diagrams, sun may have the risk of falling lower, especially if the total value locked (TVL) falls on

In the last month, Solana’s price Has shown some sluggish market results and dropped by 36% on the lists. At the time of writing, the Martket feeling seemed to suggest a further decline when more sellers entered.

An analysis of the liquidity movement revealed a hike in sun outflows over the past month. This is a trend that seems to continue, especially since it loses an important level of support that would usually give a recovery.

Momentum falls massively when sun is weakened

An important contributing factor to Solana’s decline has been the sharp case in speed. In fact, press time data revealed that Altcoin’s trade volume has dropped to its lowest level, by only $ 3 million in daily trade volume – a level that last seen in September 2024.

When both trade volume and price fall at the same time, this means that the market players sell their holdings. This can potentially lead to further reductions in demand.

TVL, which traces the liquidity flow within Solana-based protocols, also fell considerably. After topping $ 12.19 billion in January, it has been almost halved, with the same position of $ 6.69 billion at press time.

Such massive liquidity outflows over protocols are a sign that investors who originally locked their assets are now selling them. This, probably due to decreasing confidence in the asset and an attempt to protect against additional falls.

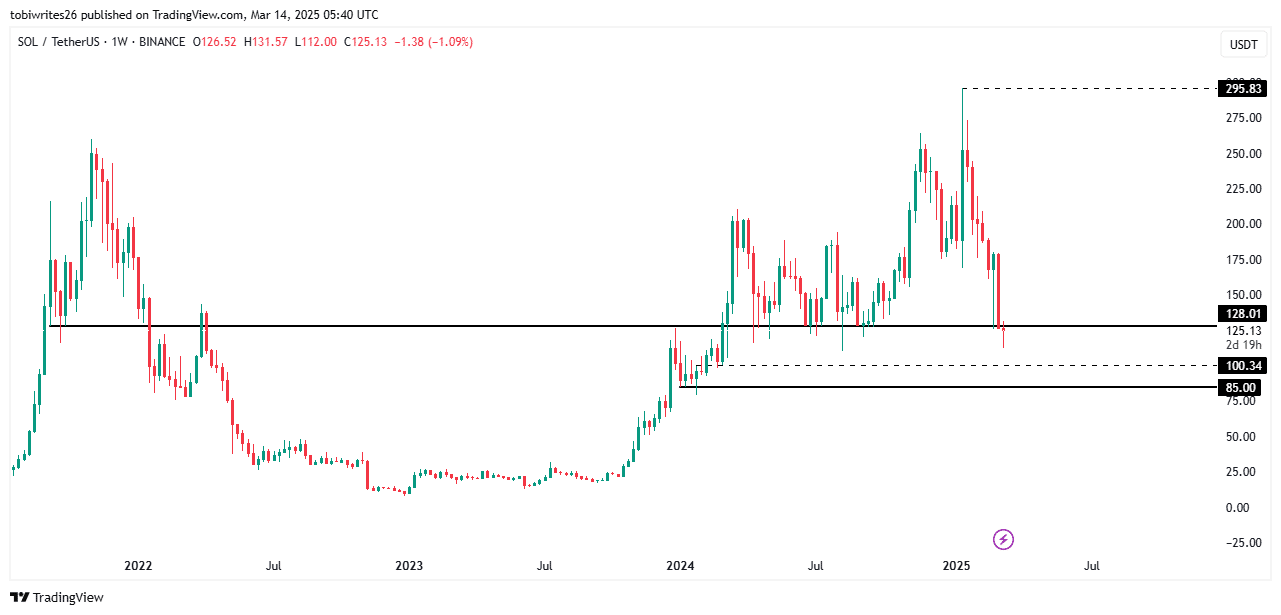

Potential case to $ 100 or lower

Ambcrypto’s analysis of Sol’s price movement suggested that access could decrease to $ 100 after losing the most important support level of $ 128.01.

Usually, support levels provide a pillow for price and facilitate returns, which creates a fall-to-rally scenario. But when they are broken, it means that the sale of momentum outweighs buying on these levels.

If the sun fails to hold over the next support to $ 100.34, decreases further to $ 85. This will bring back access to the two-digit price range-a level that last seen in 2024.

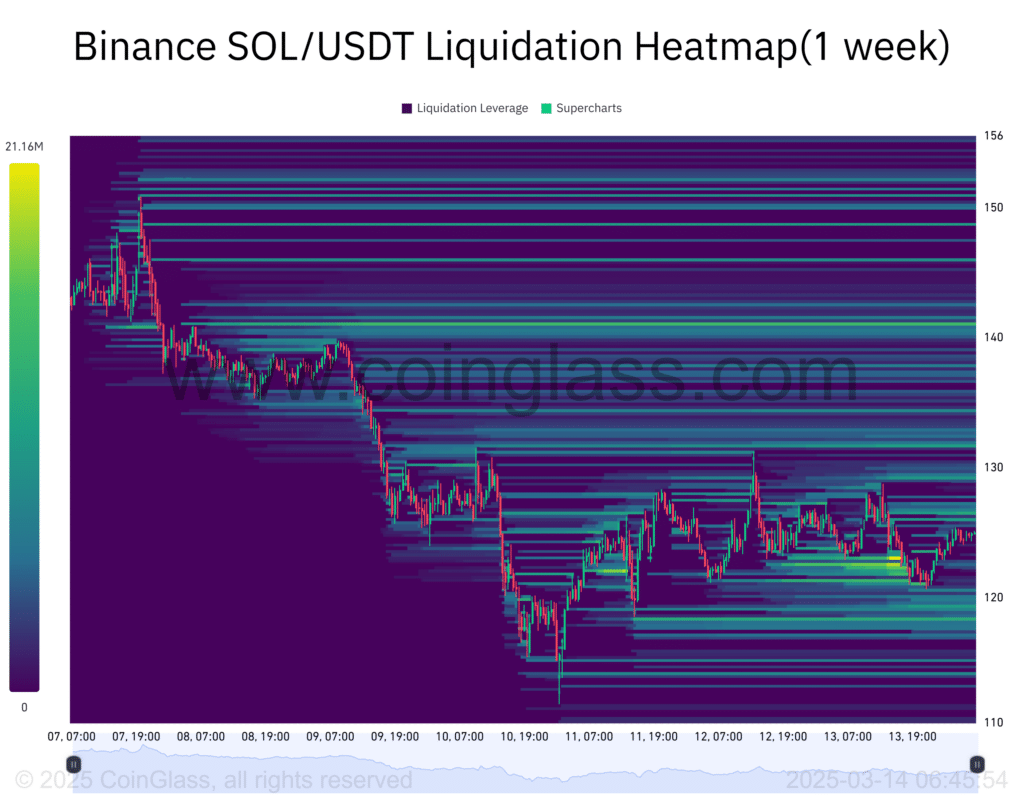

An analysis of the liquidation heat map revealed several liquidity clusters between $ 120 and $ 114. These clusters often act as magnets and draw the price against them and in some cases press it lower.

Given the prevailing downward trend, the sun can sink further and put new lows on the lists.

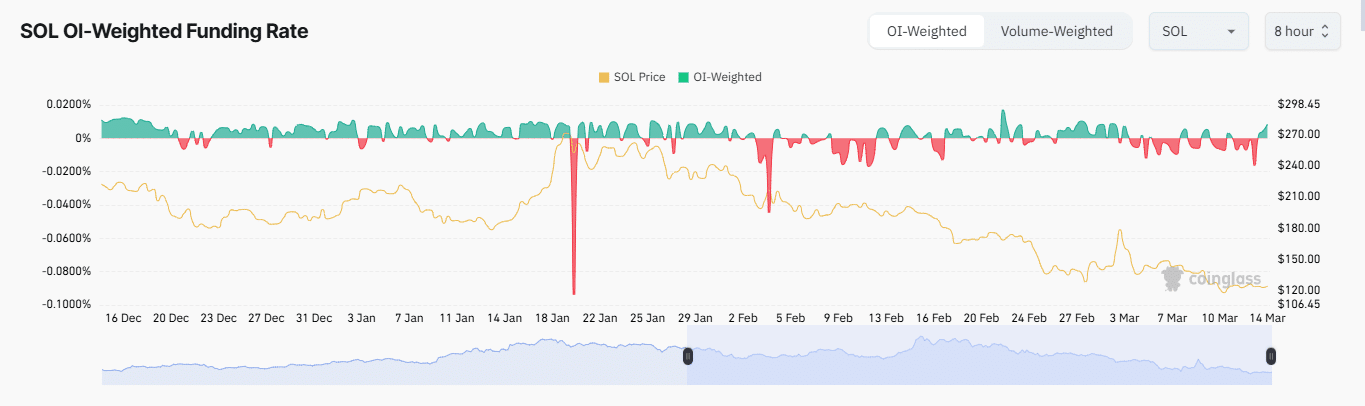

Not all traders are baisse -liked

In the derivative market, some traders have placed long investments while waiting for a sun recovery. Recently, the purchase volume in the derivative market has increased together with the unpaid financing rate.

Coinglass’s long-to-short relationship, which measures the purchase volume in relation to the sales volume, had a reading of 1,004 at press time. A level above 1 indicates that there are more buyers than sellers within that period.

This sense of purchase can be further confirmed with the OI-weighted degree of financing, which combines open interest rate and financing frequency data to provide a more accurate market term. At the time of writing, the feeling had become positive and registered at 0.0086% thanks to a trend that began on March 13. This suggested an increase in long positions.

If the volume of the purchase in the derivative market remains strong and Soana Reclaims the lost support for $ 128, a recovery can be imminent. Otherwise, altcoin may fall further.