- Solana buyers and sellers in the derivative market have registered the same amount of loss and points to fatigue.

- Activities in the market are in line with a raised story and the opportunity that Solana’s next move can be Hausse.

The latest development with Solana’s (sun) Losses, registered in the derivative market, have shared the feeling. In fact, sun had risen 14.56% during the week and 6.50% during the month.

However, Ambcrypto observed indicators still favored buyers, which means that the next decisive oscillation could lean upwards.

Sun stalls with $ 13 mln in liquidations

Over the past 24 hours, liquidations in the derivative market saw an equal division between long and short positions per coinglass.

Both sides lost $ 6.5 million each, signal dealer fatigue and determination. Of course, this tensile fight often results in muted price measure, and that is exactly what was played out.

Sol’s daily profit stood at just 0.7% during the same period.

When liquidations are evenly matched, the market tends to tip, unsure of the next move. However, Ambcrypto’s analysis suggested that bulls still had a small edge.

In fact, the price can still break to their advantage – if speed follows through.

Important activities benefit the bulls

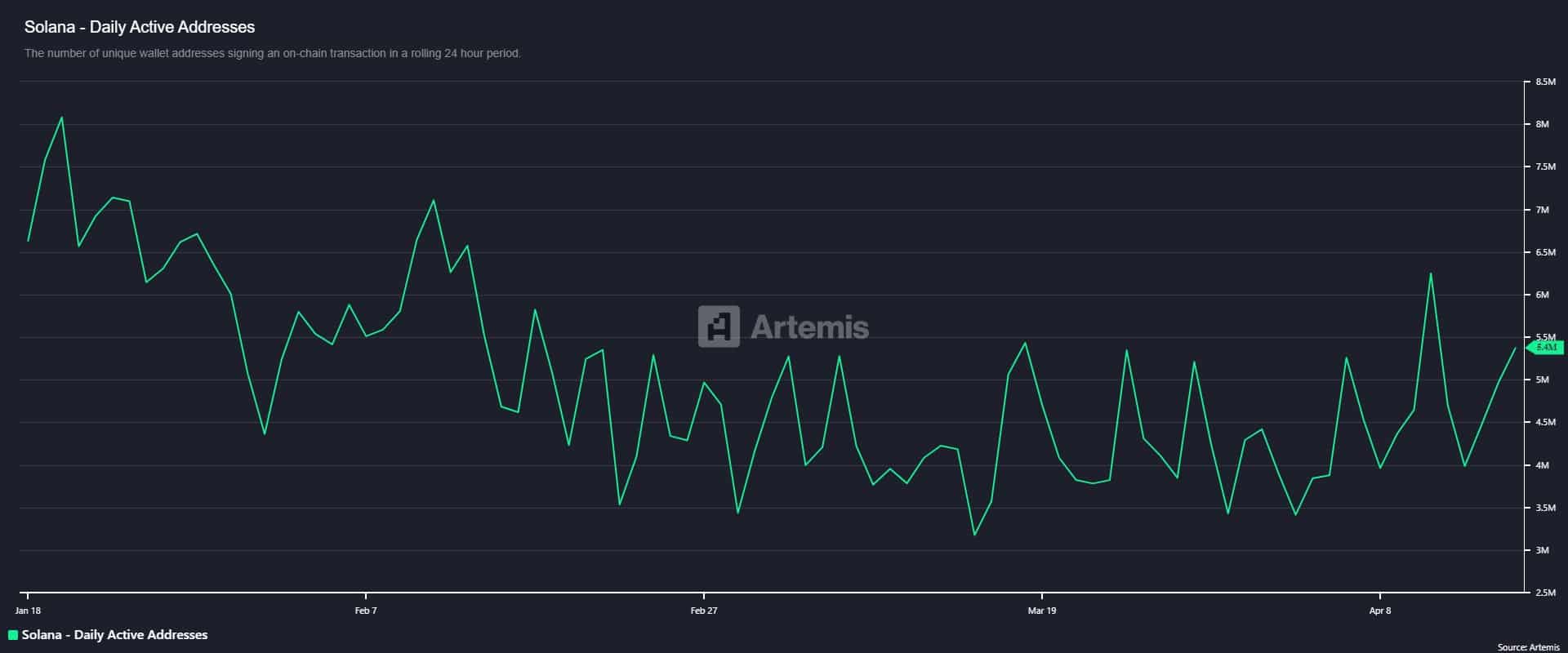

In addition, the chain strengthened that view. Unique active addresses increased 31% within 24 hours and reached 5.4 million, according to Artemis.

This nail suggested fresh purchases or reception of sun, intensified hausseartan expectations.

This corresponds to the growing trade volume on decentralized exchanges (Dexes), which saw an increase of 15.35% over the past week and reached $ 16.2 billion – which made the Sola chain with the highest Dex volume.

The haus -like story is also in the futures market.

The amount of uncontested contracts continued to grow, together with the volume of the purchase in the derivative market.

Open interest, which records the amount of unreleased derivative contracts, has nevertheless continued to increase. These contracts include both long and short positions.

The long-to-short relationship, which effectively compares buying and sales volume in the derivative market, provides readings above 1 to support a haus-like feature and below 1 to propose the seller’s dominance.

At the press time read long to short ratio 1,0087, which indicates more purchase volume. This probably suggested that the growing open interest was dominated by long traders, which increased the probability of a price collection.

Over the past 24 hours, investors’ confidence has continued to grow as liquidity streaming into Solana rose by approximately $ 72 million, giving its total value locked (TVL) to $ 7,144 billion.

As TVL climbs, this means that more investors lock their solar antybs long-term commitment to protocols to enable various activities, including liquidity provision.

If the market continues to reflect several hausse -like signals, it is likely to be skewed in favor of the bulls, with sun rallying.