South Africa Decentralized financial funding (Defi) is expected to reach 378,000 users at the end of this year, says a new study of the country’s Financial Industry Watchdog.

“Market study: Decentralized Financial in South Africa,” was completed Through the financial sector, authority conducts and divided into the growth of defi in the country and the opportunities and risks facing consumers.

The study, which involved 21 Defi services that operated in South Africafound that the Defi market hit $ 116 million in 2024. IT projects that the sector will register a compound annual growth rate of 11.82% to suffer $ 180.7 million in 2028.

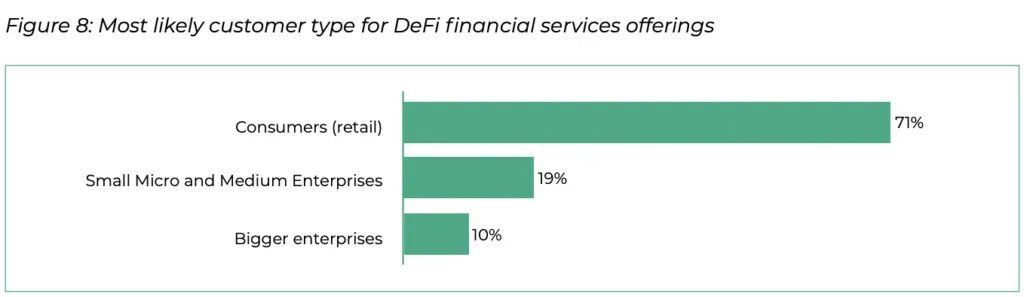

Retail investors dominate Defi in South Africa and account for 71% of all activity, FSCA found. SMEs (small and medium -sized companies) have a share of 19%, almost twice as much as larger companies. This distribution is not a surprise: Since Defi is loosely regulated, most large companies have clearly ruled in fear of regulatory repercussions.

South Africa’s Defi growth in 2024 in line with global growth in the sector as defi platforms favored by a two-facade bull market last year. Between October 2023 and May 2024 the total value is locked (TVL) in defi -smart contracts triple to $ 107 billion. A dip followed, but a “crypto” bull rally towards the end of the year, arose by Donald Trump’s election In the United States, it pushed over $ 138 billion in mid -December. The record was set at $ 180 billion in 2021.

Defi lumps several different digital assets use cases together. In South Africa, payments were the most common defi applicationWith lending and loans, decentralized exchanges (DEX), tokenization and Stablecoins are the other popular use cases.

In payments, non-caregivers Web3 wallets Was the fastest growing defi trend in 2024, FSCA revealed.

“This innovation has now made it easier for South African customers to buy crypto assets from Fiat for their wallet and vice versa, through local bank infrastructure. It also allows individual customers to change their fungal symbols, such as crypto assets, for other fungal symbols, ”the authority told about self -love Wallets.

Defi for economic inclusion in South Africa

Despite the rapid growth over the past year, Defi remains a minute part of South Africa’s financial sector. With a population of 64.4 million, the 378,000 Defi users account for only 0.59%. The $ 2.9 million in revenue connections generated last year are also a decrease in the sea compared to the $ 6.2 billion that the country’s four largest banks alone generated in 2023.

However, it is a positive start and can lay the foundation for economic inclusion in a country there a third of the population is under -banked.

The FSCA study shows that South Africans rely on Defi to solve some of the challenges that plague under -banked countries, such as lack of access to credit and overload cash. Defi-based lending and loans enable users to circumvent inheritance financial institutions, which are oblique to low-income customers and access credit facilities directly in a peer-to-peer platform.

Tokenizationthe fourth highest defi-use case in the FSCA study, also opens up Opportunities for economic inclusion for South Africans. Tokenized assets on a public corporate blockchain are easily divisible and easier for detailed investors to access. For example, a real estate project that costs millions of dollars and would have been inaccessible to retail investors can be failed and sold as tokens.

In order to take advantage of these benefits, South African regulatory authorities must conduct enabling the sector policy, the FSCA report acknowledged.

“If South African Defi develops in a way that protects consumers and builds trust, it can support competition and financial inclusion, which reduces dependence on traditional financial intermediaries,” the authority noted.

Among the policies that limit the defi assumption is a provision that prohibits South Africans from exporting capital outside the country. In accordance with This includes the central bank to buy digital assets on a local exchange and send them to a defi wallet address on an offshore platform. Violating this law can imprison investors for five years, incur a fine of $ 13,600 or both.

Look at | Rediscover blockchain: How to build trust in scale

https://www.youtube.com/watch?v=apyi_yet4So Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard writing; encrypted media; Gyroscope; Image-in-Image; Web-Share” Reference Policy = “Strict-Origin-When-Cross-origin” Permitting Lorscreen = “” “” “