- Stellar’s latest price movements have received attention due to significant volatility, strong rally and sharp backbacks.

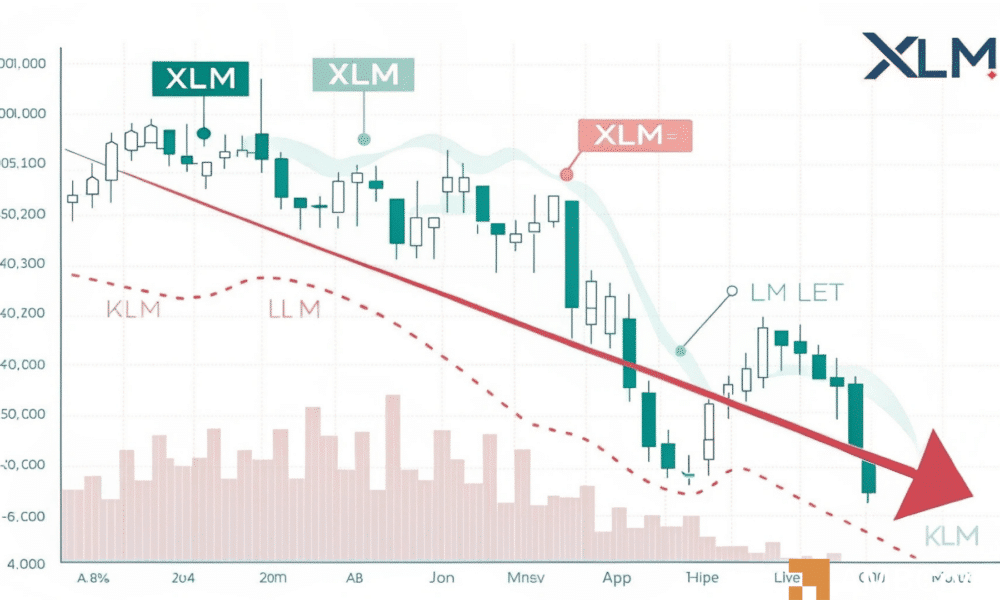

- XLM’s 1-hour diagram confirmed a break from upward, with the price that fell from $ 0.3317 to $ 0.2855.

Stellars (xlm)The latest price movements have been noticed due to significant volatility, strong rally and sharp backbacks.

The sudden increase was followed by a correction, which reflects typical market cycles where traders balance profit against new accumulation.

By analyzing price measures, trend shifts, volatility and marketing term, traders can assess whether Stellar is ready for another rally or further decline.

XLM/USDT experienced a price drop of 24.6%, which fell from $ 0.37963 to $ 0.2855, after testing a support range of $ 0.26- $ 0.27.

Rally that led to this decline was probably driven by Fomo purchases, followed by profit.

The 7-period SMA to $ 0.2985 indicated Baisse-Tarted feelings when the price dipped below the trend line. Historical trends indicate that corrections over 20% often precede renewed hausseartat momentum.

If the $ 0.26 support holds, accumulation may trigger a recovery. However, a break under $ 0.26 can lead to a further decline to $ 0.22.

Signs of a trend use and important market signals

XLM’s 1-hour diagram confirmed a break from upward, with the price that fell from $ 0.3317 to $ 0.2855. The 7-period SMA to $ 0.2985 reinforced the transition to Baisseish feeling.

The degree of change (ROC) at -12.13 suggested to a possible short -term recovery. But MACD on -0.00347, with a signal line of -0.01278, suggested continued weakness.

If ROC becomes positive, the price can test $ 0.30, similar to previous recovery. But failure to recover $ 0.2985 can lead to a $ 0.27 test.

A backed MACD crossover may indicate a trend use, while prolonged baissalists can delay the recovery efforts.

Market Volatility and its impact on future price measures

XLM’s price fluctuations remain significant, with the Volatility Index of $ 0.29240. New oscillations between 0.37963 and 0.2855 $ highlighted sharp price movements.

Volatility nailed when the purchase pressure escalated, but relieved when it was to sell intensified. If volatility drops below 0.25, price consolidation may occur close to $ 0.27, which offers stability.

Conversely, a wave above 0.30 can precede another decline to $ 0.22. Historical patterns suggest that volatility spikes in addition to 0.35 often lead to sharp corrections.

XLM: How do traders position themselves?

XLM’s long/short relationship provided insight into business position. Room -purchase/sales volume relationship topped at 1.30, which indicates scary dominance, with 60% long positions versus 40% shorts on March 3, 00:00.

The long/short accounts relationship reflected this trend, with longs at 55% and shorts of 45%. The imbalance drove the price to $ 0.37963, but the subsequent correction to $ 0.2855 suggested profit and short coverage.

A decrease in the ratio below 1.0 may indicate a growing baissey feeling and squeeze the price against $ 0.26. Conversely, a recovery over 1.2 can support recovery against $ 0.30.

Historical trends show that long -term long dominance often precedes corrections, making emotions an important indicator for traders.

In summary, XLM’s price movements reflect a market in flow, with recent volatility that offers both risks and opportunities. The decline of 24.6% tested critical support to $ 0.26- $ 0.27, with a break lower potential which led to $ 0.22.

Volatility remains high, and emotions in long/short conditions can dictate the next move.