- Krypto capital inflows have dropped 70% in two weeks, while fear levels have remained unchanged.

- Bitcoin ETF inflows remained strong and signal institutional conviction in the midst of retail waste.

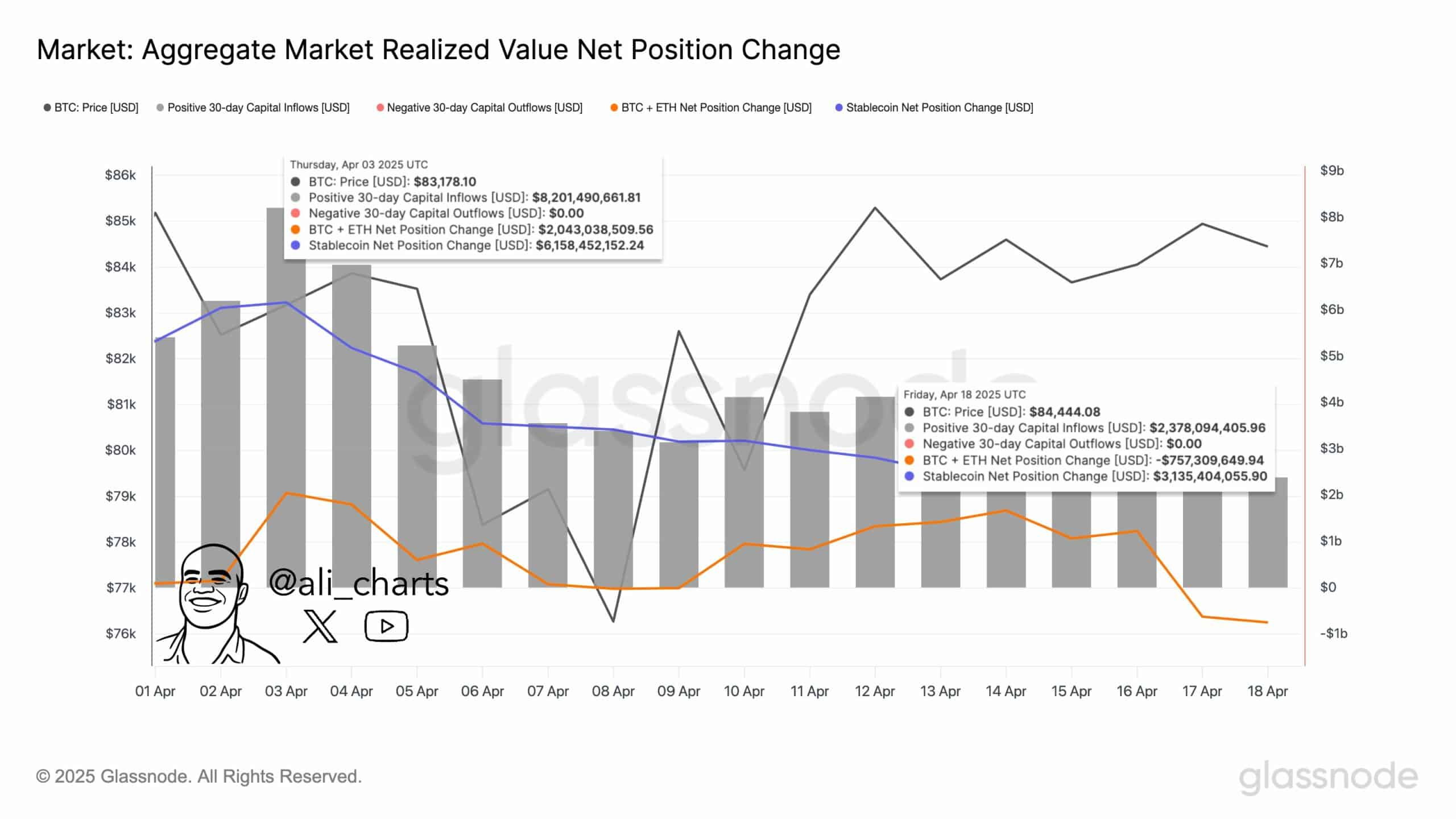

Capital inflows in Crypto market Has dropped sharply by over 70% in just two weeks and collapsed from $ 8.2 billion on April 4 to just $ 2.38 billion by April 18.

This dramatic contraction reflects a wave of investors caution in the midst of rising market vollatility and intensifying macroeconomic pressure.

The sudden unmathing signals A shift in risk, as both retail and institutional participants trim exposure to volatile assets.

Although the market had kept Hausseartat Momentum earlier in the year, the current conditions indicate that participants re -evaluate their positions in response to the broader economic environment.

Why fear of the crypto market again

Of course, sentiment data supported this behavioral shift. Fear and greed index remained stable at 33 – strange in “fear” territory.

This level has remained unchanged for weeks and floats at 32 last week and 31 previous months. Therefore, the market is caught at a psychological distance, with buyers who are unwilling to enter aggressively.

Historically, long -lasting fear stages have preceded both sharp returns and deeper corrections.

However, the lack of volatility in the feeling means hesitating rather than panic, which suggests that participants are waiting for stronger macro or prize signs before making decisive features.

How inflation fertilizes weigh on crypto confidence

In addition, the macro pressure was only intensified. According to recent data, 1-year inflation expectations increased 1.7 percentage points in April and met 6.7%-the highest level since 1981.

This marks the fourth straight monthly increase, with inflation expectations that increased a total of 4.1 percentage points since November 2024.

In addition, 5-year inflation expectations are now at 4.4%, the highest since June 1991. At the same time, the consumer’s feeling has dropped to its second lowest level on record.

Together, these figures screamed stagflation. And, of course, crypto-fast is considered a high-risk asset class-redeemed from this growing fear.

Can ETF inflows prevent a complete retreat?

However, there is a bright place in the middle of the gloom. Bitcoin (BTC) ETFS registered a net inflow of $ 107 million on April 17, and lifted the monthly total to $ 156 million.

In fact, over the past three months, Net ETF inflows crossed $ 1 billion – which showed that the institutions did not completely pass away from Crypto.

While Ethereum ETFs remained flat, this divergence’s bitcoin’s perceived strength illustrates as a safer venture.

In addition, long-term ETF inflows can offer the market a degree of stability and prevent panic-driven capitulation in the short term.

Where does the crypto market go next?

The sharp reduction in capital inflows and persistent fear signals that grows caution. However, this is stable institutional inflow through ETFs indicates that investors do not abandon the crypto market.

Instead, this seems to be a short-term recovery driven by macro fear rather than a structural degradation. If inflation expectations are stabilized and the feeling improved, crypto markets can find the foot for a renewed rally.