Key dealers

- President Trump signed a resolution that turned an IRS rule that required Defi platforms to report crypto transaction data.

- The reversal relieves the overload of the Defi participants with legislative requirements, which supports digital asset innovation while dealing with the information agreements of privacy and taxpayers.

President Donald Trump today signed legislation that annulled an IRS rule that would have required decentralized financial platforms (Defi) to report crypto transaction data and collect customer information, according to one press release Issued by Rep. Mike Carey, who introduced the bill together with Senator Ted Cruz last December.

“This is the first Cryptocurrency bill ever signed by law and the first tax-related congressional law of dissatisfaction (CRA) signed the law,” stated release.

“The Defi Broker Rule Needlesly Hindered American Innovation, Infringed on the Privacy of Everyday Americans, and was set to overwhelm the irrs with an overflow of new filings that it does not have the infrastructure to handle durring season. Congress have given the irrs an opportunity to return its focus to the duties and bond it already owes to american taxpayers institute of creating a new series of bureaucratic obstacles, ”pronounced rep. Carey. “I thank President Trump for signing this important legislative proposal in law and crypto bags for his leadership to support the United States’ continued place as the global leader in the growing crypto industry.”

The measurealso known as Hjres.25, aims to make IRS’s “gross income reporting by brokers that regularly provide services that affect digital asset sales”.

This rule, which was introduced during the last days of bids’ term, extended the definition of “brokers” to include non-caregivers such as defi platforms and trade service providers.

As part of the extended range, Defi projects would have to report gross revenue from crypto sales and collect taxpayers’ information, including identities and transaction stories.

The resolution’s assumption means that the rule “will not have any power or effect”, immediately cancellation requirements for defi platforms and other digital asset brokers to report gross income for sale on Form-1099.

Its cancellation reduces the compliance load that is criticized as impractical and innovation by many members in the cryptos sector, such as Blockchain Association.

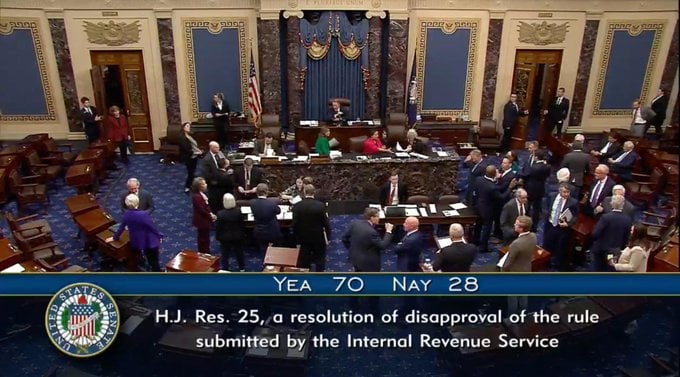

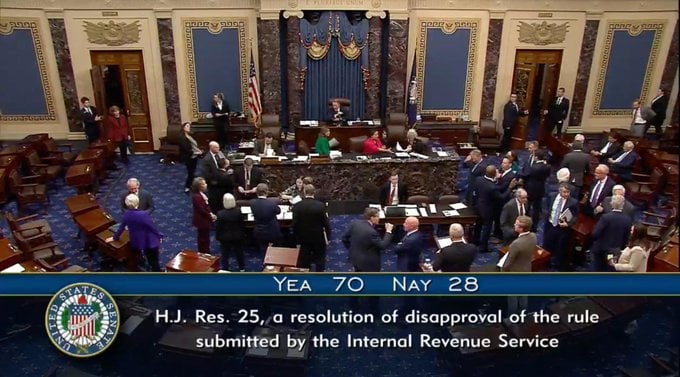

The action cleared the Senate on March 4 before passing the house the following week. Given the action’s connection to a budget issue, a final vote in the Senate was necessary before it was transferred to the president.

On March 26, the Senate voted to cancel the controversial crypto tax rule.

According to the Act on Congressional Overview, the IRS cannot issue a substantially similar rule without the permission of new congress. This prevents the agency from imposing comparable reporting requirements on digital asset brokers without explicit approval from Congress.

Trump’s signature is in line with his administration’s liberal attitude, especially against new techniques such as Crypto, which he has increasingly embraced during his 2024 campaign and other term.

The White House has approved the resolutionIn a statement of the Biden-ERA rule, the biden-era rule adversely affects American innovation, arouses serious privacy issues related to taxpayers’ information and puts an unreasonable compliance with defaults.