- Trump seemed to test the key support to $ 23.88, with RSI at 32.79 Signal Overcome Conditions

- The marketing position was careful when the social volume decreased and open interest fell by 4.54%

Official Trump (Trump) May be on the verge of a recovery because TD -SSEVIVAL indicator flashed a purchase signal on the daily chart. After a long -term decline, this can mark the beginning of a potential recovery phase.

If the purchase pressure increases, the price may try to recover important resistance levels. However, uncertainty remains when market conditions continue to vary. Will this signal trigger a long -term causal reversal in the coming days?

An ongoing controversial debate

The Trump token has led to heated discussions in the crypto community, with some who see it as a causal catalyst and others who warn of potential instability. On the one hand, the launch showed a growing interest in political memecoins, which could attract new liquidity to space.

Critics, however, claim that it has emptied capital from more reputable assets, which leads to volatility in several markets. At press time, Altcoin was about $ 24.27, down 5.98% – a sign of mixed investors’ feeling.

Trump’s price action – test key support levels

The Memecoin Price has been consolidated within a critical support zone to $ 23.88 – a level that can determine its next major move. If the Bulls manage to drive it over $ 28.13, a force against $ 40 can follow, giving the traders renewed confidence.

In addition, the relative strength index (RSI) was 32.79, indicating that Trump may approach monitoring territory. If RSI rises above 37.51 in the short term, it can buy momentum strengthen and improve the chance of a breakout.

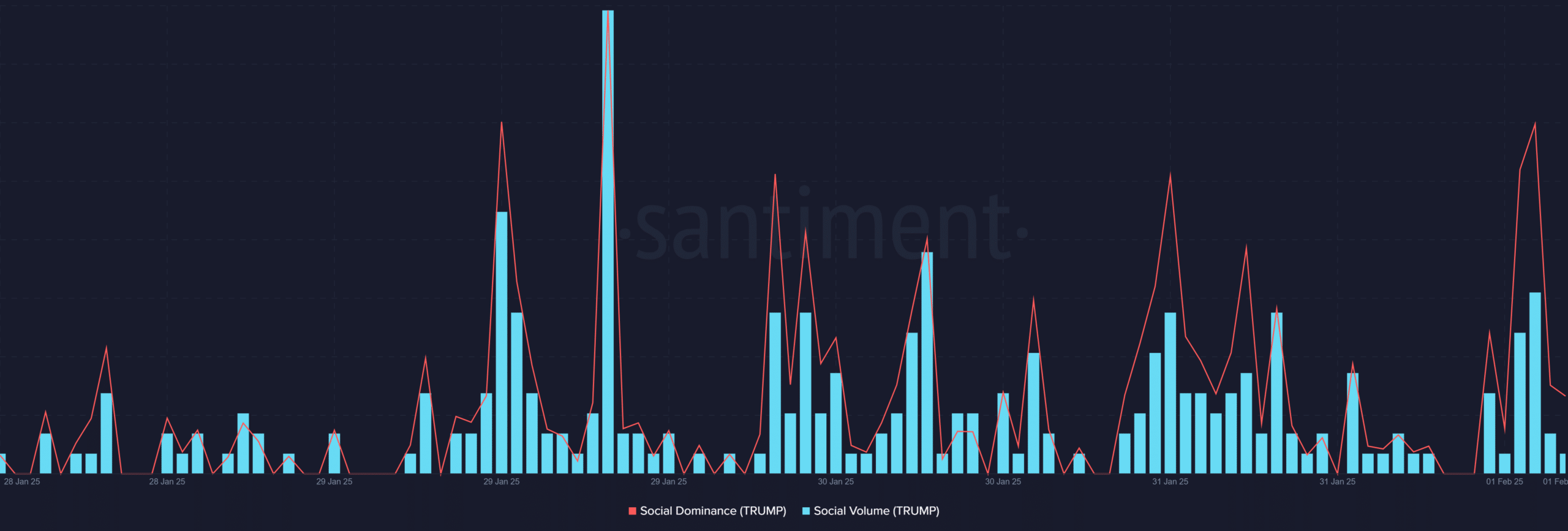

Trump Social Volume and Dominance – a fading hype?

While Trump was originally gained massive traction, the latest information suggested on a decline in his social volume and dominance. In fact, Santiment Analytics revealed that social volume topped by 2.0 mentions per hour on January 29. But it has since dropped considerably.

In addition, social dominance fell to 0.33% – a sign of a case in traders discussions about the token. This reduction in hype can mean weaker buyingress, which makes it more difficult for bulls to maintain a trend on the lists.

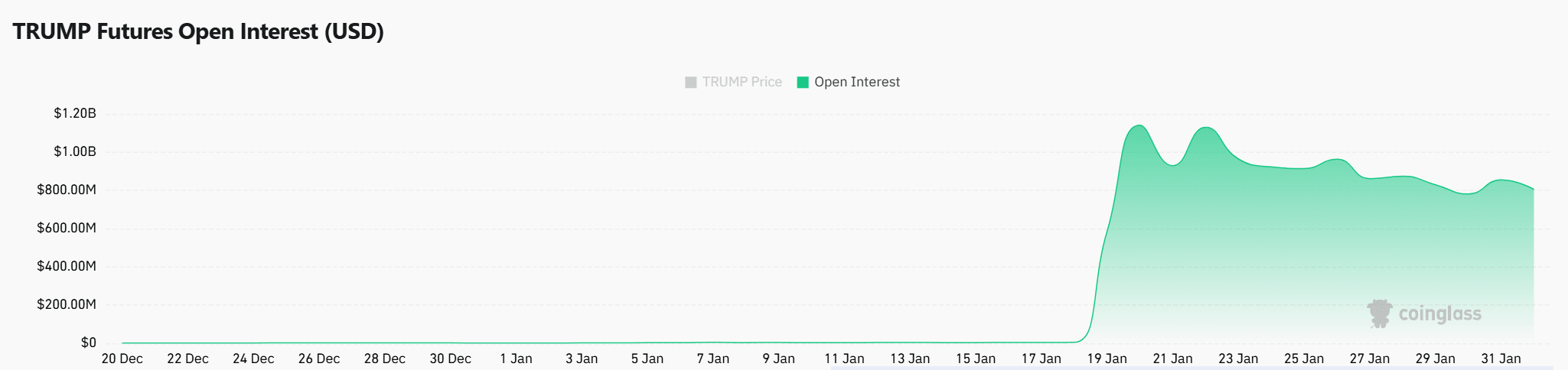

Open interest – does traders lose confidence?

Open interest rate fell by 4.54% to $ 833.39 million, which indicates reduced trade activity. Usually, rising open interest means confidence in a potential feature, but the latest decline seemed to suggest hesitate.

In addition, this decline can mean that traders close positions rather than invest in a large prize wing. If open interest continues to fall, it may refer to further disadvantages.

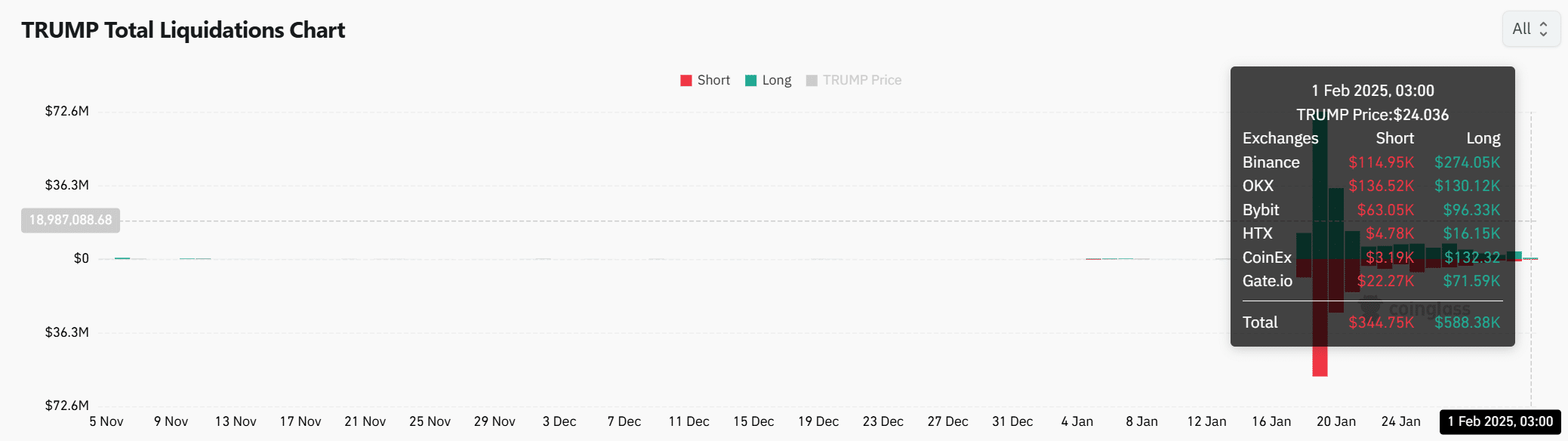

Total liquidations – what do they reveal?

Liquidation data revealed that $ 344.75,000 in short positions and $ 588.38,000 in long positions were obliterated. Simply put, both bulls and bears have had challenges when price vollatility increased across the line.

But if short liquidations intensify, a short press can drive Trump’s price higher on the lists. Therefore, traders should carefully monitor liquidation trends for signs of an upcoming breakout.

Trump’s price remains at a critical time, where breaking over $ 28.13 can trigger a raisy reversal. On the contrary, not keeping support can lead to more losses.

Read Official Trump’s (Trump) Price President 2025-26

With declining social volume and open interest, marketing terms can seem somewhat cautious. But about hausse -like speed, Trump may recover lost land in the coming days.

At the moment, traders should look at key levels before confirming a clear trend shift.