Italy’s top bank has warned that the increasing interaction of “crypto” and the financial industry pose a risk to the global economy.

In its “financial stability report”, Banca d’Italia noted The fact that there has been a sharp in investment’s interest in “crypto” since Trump’s election, which led to price increases for most symbols.

“If these instruments were to be more closely intertwined with the traditional financial system, there may be greater vulnerabilities for markets and intermediaries,” the bank said.

The Italian regulator is the latest that prompts Trump administration And its intrase with the “crypto sector”. The US President owns a Memecoin projectswhich in its premiere was worth $ 14.8 billion. He has also replaced supervisory authorities that were strict with the “crypto sector”, As Securities and Exchange Commission’s Gary Genslerwith the appointed which is ready to look the other way. Trump is also pushing on a BTC National Reserve And other legislation in Congress that threatens the US financial system.

“The strong growth of bitcoin and other crypto resources with high price volatility means that risks not only for investors but also potentially for financial stability, given the growing interconnections between the ecosystem of the digital asset, the traditional financial sector and the real economy,” says it Italian.

The top bank shouted “marketing players” who write about their business models to be crypt -focused. Such companies, led by Micro strategy (Nasdaq: mstr), “Invest in the belief that BTC can support its stock prices, even if this exposes them to its significant price vollatility.”

Italian companies have also jumped aboard the bandwagon. In JanuaryNasdaq: iitsf, purchased BTC of $ 1 million and became the first lender to make such a purchase in Italy.

Stablecoins Also poses a major threat, says the top bank. At present, the market is dominated by USDT and USDC, both issued by US companies and linked to the US dollar. These issuers rely mainly on US government bonds as reserve resources. If any of the issuers failed (and Terra’s catastrophic Ust The StableCoin project has shown that they can fail), it would be a run on redemption, which can destabilize the US bond market.

The Italian central bank echoes opinions from several economic leaders who are globally concerned about Trump’s “Crypto” association. In March, the European Central Bank (ECB) board member Francois Villeroy de Galhau stated that the United States “sinned through negligence.”

“By encouraging crypto resources and non-banking financing so the US administration sowing seeds from future upheavals,” he abandoned.

$ 650 billion in Stablecoin volume was linked to crime 2024: Report

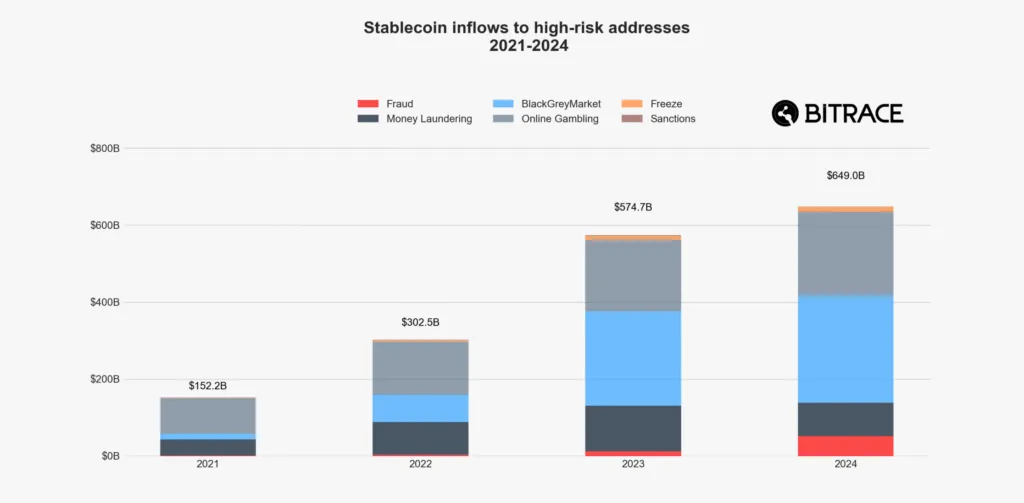

Illegal activity accounted for over 5% of all Stablecoin transfers last year, worth almost $ 649 billion, a new report has revealed.

“2025 Crypto Crime Report” by Blockchain Data Analysis Bitrace revealed The StableCoin inflow to high-risk addresses (those used by illegal units) shot up to $ 75 billion in 2024, the year before.

Illegal Stablecoin transactions accounted for 5.14% of the total volume last year, a small dip from 5.94% the year before, but still a significant jump from 1.63% in 2021.

Faith has retained its position as Stablecoin Crime Haven for four years now. Since 2021, USDT on Throne networks has accounted for at least 60% of all illegal volume. In 2024, its dominance was over 80%, with USDT at Ethereum for a remote second. USDC at Ethereum represented a fraction of the volume.

The dominance of faith is remarkable, especially considering that Ethereum has almost twice as much Stablecoin value. However, the belief has an edge over Ethereum With USDT, with 47% of the supply to Ethereum’s 45.5%. This little edge fails to motivate the massive leadership of faith on the crime diagrams.

By breaking down crimes, money laundering addresses received $ 86.3 billion in Stablecoins last year, a significant decline from the $ 118 billion received in 2023, the report reveals. Fraud was $ 52.5 billion, while black and gray market addresses received $ 278 billion. Inflows to online gaming addresses shot up 17.5% to suffer $ 218 billion.

Centralized exchanges played an important role in Stablecoin crime, which allowed the criminals to pay. Not surprisingly, Binance Topped the charts and accounted for about 40% of the illegal volume as its proportion to years increased. Other remarkable players included Justin Suns HTX, OKX and Kraken. Noteworthy was the crime’s share of the crime revenue the highest in relation to the total trade volume. While HTX and OKX usually deal with over $ 3 billion daily, the Craken records less than $ 1 billion.

Crypto crime

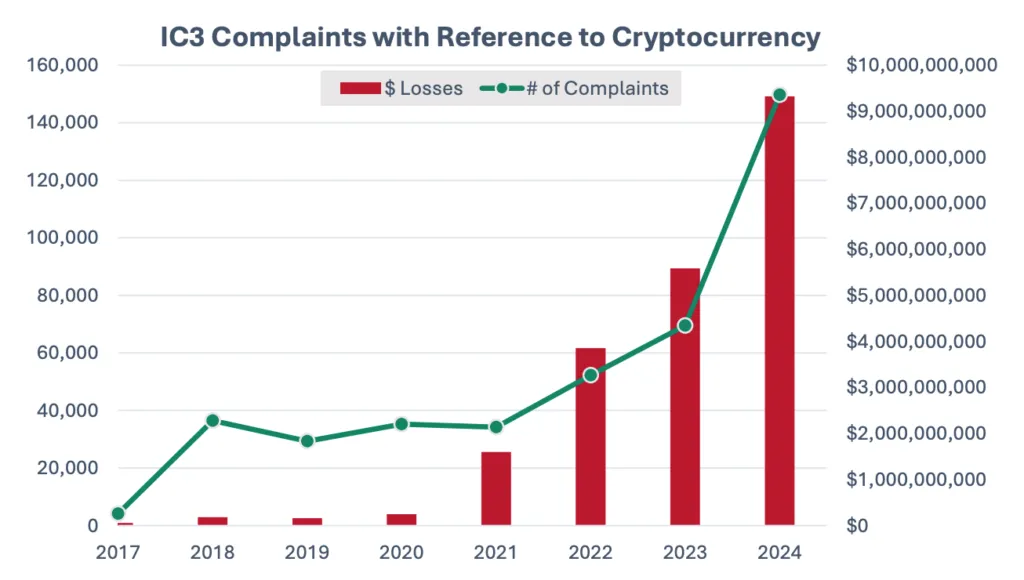

Bitrace report comes just a few days after the Federal Bureau of Investigation (FBI) Published Its Internet Crime Report 2024, which revealed that the “crypto” crime shot in the United States last year to take into account 56% of all cyber crimes.

The Bureau received almost 150,000 complaints about “crypto” crimes in 2024, twice as many as 2023. It was a 66% increase in losses, which hit an astonishing $ 9.3 billion, with the victims over 60 years affected at least twice as much as any other demographic.

The “Crypto” investment fraud was the most common, which led to $ 5.8 billion for investors. Fraud related to ATMs and kiosks doubled last year to suffer $ 247 million, with extortion and technical support as the crimes most associated with the victims.

The report further revealed that Californians were the most targeted, with 20,000 complaints, almost twice as much as other placed Texas. Florida was third, just before New York. California’s $ 1,393 billion in losses was also the highest in the country, twice as high as Texas $ 738 million.

Experts and industry stakeholders are worried that the crimes may skyrocket during the Trump administration. The Republican leader, to love himself to ‘crypto bros“It donated millions to his campaign has eliminated some of the safeguard measures that have protected investors for several years.

For example he scrapped National Cryptocurrency Enforcement Team Last month, whose mandate was to investigate and take down “crypto” criminals. This, said the Department of Justice (DOJ) in its pmwould exit “regulation of prosecution.”

“In the midst of this background of growing crypto crime, the administration moves from being Crypto’s judge to his cheerleader,” says Amanda Fischer, COO for better markets, a non -profit organization that promotes public interest in the financial sector.

“With Crypto Crime Run Amok, Congress should reject the efforts to further integrate crypto into the Americans’ wallets. Current legislative efforts simply transform existing law – which clearly does not work or enforced by the current administration.”

Despite the worry, Trump continues to Embrace the “cryptosector”including criminals who had previously been convicted. This includes issuing pardon to Bitmex founders Arthur Hayes and Ben Melo, as well as Silk Road -founder Ross Ulbricht. Bitmex -Admitting wiped out a 100 million dollars fines against exchange.

Look at | Bitcoin Mining 2025: Is it still worth it?

https://www.youtube.com/watch?v=27HNIUFI8HQ Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard Writing; Encrypted Media; Gyroscope; Image-in-Bild; Web Dividend” Reference Policy = “Strict-Origin-When-Cross-Origin” Allowing Lorscreen = “>”