Trump Family launches Bitcoin Mining Venture with Hut 8

This week the Trump family took another step deeper into the crypto world by acquiring an effort in a new Bitcoin mining Operation called American Bitcoin. The new company, formerly American Data Centers Inc., has reclassified as part of the business and is a majority -owned and run by listed mining companies HUT 8 (Nasdaq: Hut).

Eric Trump and Donald Trump Jr. is part of a group of investors who take a 20% share in the new company, while HUT 8 contributes most of their ASIC miners to the effort for 80% ownership. The company’s business model is simple: MIN and Lager BTC with the intention of the first public offer (IPO) in the future.

“It is a great honor to collaborate with Hut 8, a recognized leader in the Bitcoin space, when we launch American Bitcoin,” mentioned Eric Trump, who now acts as the company’s head of strategy.

Donald Trump Jr. Added, “From the beginning we have supported our belief in Bitcoin – personally and through our companies … simply buying bitcoin is only half of the story. Breaking it on favorable economy opens an even greater opportunity.”

On the surface, this feature signals a deeper commitment from the Trump family against the Cryptocurrency industry, a space for which they have made their support. But as a spectator, this trait can also be a market signal. Every major Trump-connected crypto-initiative so far, all from the launch of $ Trump Memecoin to Eric Trump’s Tweet that tells his audience to buy Ethereumbeen followed by significant drops on the market. Since the announcement of American Bitcoin, the price of BTC has already dropped about 2%. This is probably a coincidence, but it is starting to be a bit of a noticeable pattern that when the Trump family launches a new product in the crypto world, then crypto prices … similar to how Jim Cramer says something about the stock market and it tends to do the opposite.

It is also important to remember that although the Trump family has a PRO-crypto, stock BTC story, their incentive is much different from the average consumer or enthusiast. While their business companies support the idea that they are investing in long -term, multi -year price estimates, it is important to remember that the profit keeps a company going on. It is safe to assume that at least a fraction of what the family stores will be sold or security at any time in the future if prices climb high enough.

Circle to stock exchange listing under ticker CRCL

CircleThe company behind USDCthe second most traded Stablecoin in volume, has potted Its S-1 with Securities and Exchange Commission (SEC) plans to become public through an IPO. If succeeded, this would make Circle the first crypto company that lists during the Pro-Crypto Trump administration.

However, this is not their first attempt to publish. In 2022, Circle tried to publish via a merger with the special purpose the acquisition company (Spac) Concord Acquisition Group ($ CND). However, the deal was completed when the SEC did not approve the necessary S-4 archiving in time (the document that would have given the Green Light deal to continue). At that time, the agency of all crypto broke, and the uncertainty in the legislation was published as a company that handled Cryptocurrencies very challenging.

However, times have changed. With Gary Genser Out of their service at Sec and a Pro-Crypto administration in place, the SEC and the White House have created a much friendlier regulatory environment for blockchain companies. President Trump has a share in several crypto initiatives and has turned the United States into a “cryptocation” part of its public agenda.

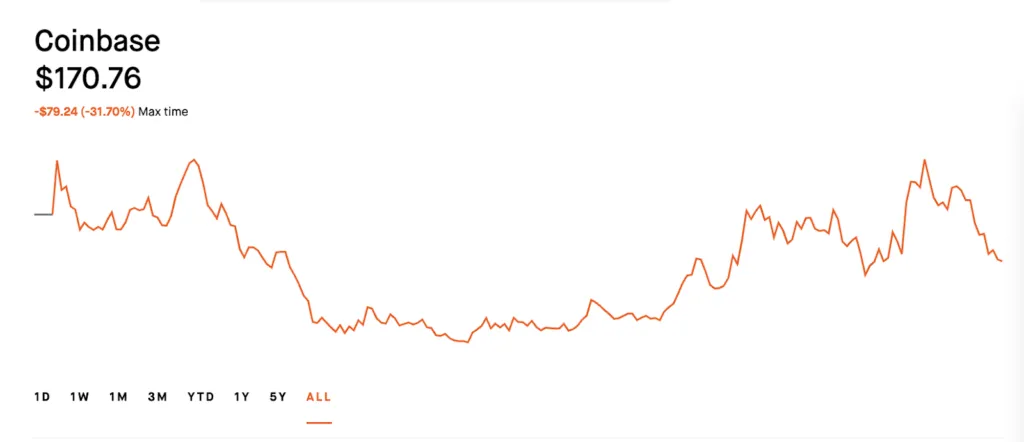

Although the IPO is likely to be a blessing for the circle itself, retail investors have reason to be careful. Historically, IPOs have not gone well for blockchain companies. Coin base (Nasdaq: Coins), for example, IPO had in April 2021 to $ 381 per share and reached the peak to $ 429.54 per share, but currently acts well below the number to $ 177.22 while they do not show any signs of recovering their stock exchange listing. For this reason, crypto -Stock Exchange – really most listed in general – can be seen as “top signals”, which indicates that insiders are paid on market peaks.

Anyway, the circle is expected to shop at the New York Stock Exchange (NYSE) under Ticker CCL. In addition, rumors are already circulating that other crypto companies will follow and ride on this wave of pro-crypto policy and feeling and make efforts for IPO. For example, The collar has already laid the foundation for IPO 2026.

US StableCoin counting is moving forward

On April 2, the US House passed the Financial Services Committee StableCoin Transparency and liability for a better principal book economy (stable) lawA significant step towards creating the first part of federal legislation that specifically focuses on Stablecoins. The vote passed 32-17 and moved the bill to the entire House of Representatives for consideration.

The Stable would require issuers to hold 1: 1 reserves supported by very liquid assets such as US dollars and government debt gears if they are accepted. It would also be mandated monthly reserve information and third -party audits from registered public accounting companies.

While the bill creates a clearer framework, it formalizes the practices that many US-based Stablecoin issuers follow. In that sense, it feels more like a public explanation of existing rules than a transformation of the regulatory landscape.

However, the creation of the stable law is likely to be valuable in the near future, such as the current regulatory environment around Crypto in the United States Could attract new players to the space that would otherwise have launched Stablecoins with unorthodox or non-compatible models.

With that said, the stable act did not come without criticism. One of the most controversial provisions prohibits StableCoin issuers from paying interest or returns for holders. This means that companies can shake in passive income from reserves while holders do not receive anything in return. Coinbase CEO Brian Armstrong recently argued to US legislation bark Let users earn interest – but the recommendation did not enter the version that passed the committee.

Another stock of controversy involves President Trump, which has an economic share in World freedom economic (WLF), a business recently Launched Its stablecoin. Critics argue that this legislation can increase legitimacy, and therefore the market value, by Stablecoins, which would directly benefit the president and raise the question of a conflict of interest between some of the cryptocation that he promotes and passes and his own business companies and activities. However, no changes were made to handle this potential conflict of interest.

Although this bill is indefinitely a step forward for digital assets, just like crypt legislation and is approaching this administration has taken so far, it benefits the crypto companies that offer products and services much more than it makes consumers and digital asset enthusiasts, even though the latter is the group of people who helped to build the blockchain industry in what it is.

Look at | Tech of Tomorrow: Diving in the impact of tech in designing the future

https://www.youtube.com/watch?v=Q7ioGew7i9u Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard Writing; Encrypted Media; Gyroscope; Image-in-Bild; Web Dividend” Reference Policy = “Strict-Origin-When-Cross-Origin” Allowing Lorscreen = “>”