Trump Media & Technology Group (Nasdaq: DJt), the company behind the truth social and majority owned by Donald Trump, is one of the latest listed companies inform Plans to create a BTC state fund. But they are not alone. A growing number of listed companies are starting to adopt this strategy, with some who buy BTC for the first time, while others top the holdings in their existing treasury.

What is a BTC tax chamber, and how does it work?

Creating a BTC tax chamber is not a new idea. But we have recently seen an increase in public companies using this strategy. In addition to Trump Media, companies like Gamestop (Nasdaq: GME), Tesla (Nasdaq: TSLA) and micro strategy (Nasdaq: mstr) have made headlines to do the same.

For starters, each company has a treasury; It is mainly the company’s war. The Treasury Department is responsible for managing cash flow, liquid assets and investments. Traditionally, this meant cashbonds and other relatively stable financial instruments. But in a BTC State strategy, a company replaces some of the traditional reserves of BTC.

This does not always mean that companies are directly dealing with their cash reserves for BTC. Some companies take a more aggressive approach and create active capital to buy Bitcoin.

Micro Strategy popularized this approach, issued corporate debt through convertible banknotes and used revenue to buy BTC. Others, such as Trump Media, have issued new shares in addition to convertible debts to raise capital and then used that funding to acquire BTC for their tax chamber.

Just a few years ago, this strategy was considered ruthless, financially irresponsible and therefore suboptimal for the shareholders. To be fair, many would still say that this is the case. But at the same time, the feeling is not as strong as before. So why do these companies take on what some people see as an unnecessary risk of holding millions, sometimes even billions, by BTC dollars?

Why are companies investing in bitcoin?

At this time, companies like Gamestop and Trump Media are late to the party. They try to take advantage of the story and success as pioneers in BTC Treasury Space, for example Micro strategyBuilt out. That being said, these newcomers follow the steps in early BTC state funds because announcement of a BTC tax chamber sends a signal to the market. It sends the idea that a company is future -oriented, includes digital innovation and is in line with the values on its growing base for retail investors who care about crypto.

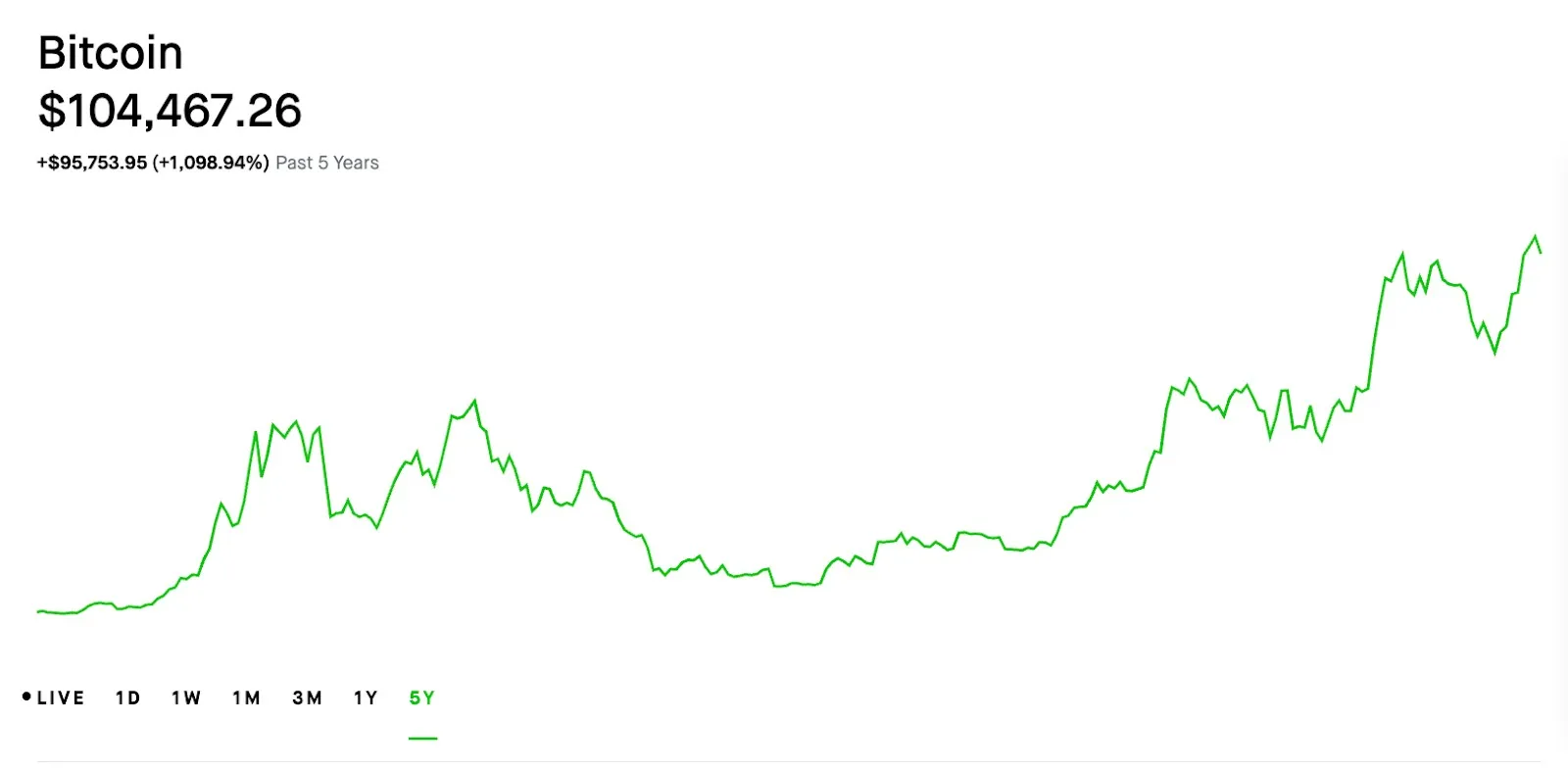

But the former adoptors –Micro Strategy (2020)The Block (former square, 2020) and Tesla (2021)– Probably built their BTC state cash registers because they had different motives. Most of these companies believed that the US dollar was weakened and they saw BTC as a way to protect their companies from inflation. They thought so Holds BTC Be a better move than holding cash because there was a chance that digital asset would estimate, and if that was the case, it would ultimately earn their shareholders better than keeping cash.

For companies like Tesla and Block, it was also BTC on the brand. Keeping BTC, especially of a large company in 2020, signaled that a company was technology ahead, chased and implemented disturbing technology.

Whether any of these motivations and incentives were actually true is debatable. In any case, one thing quickly became clear about BTC state cash registers: To announce that your company created a BTC tax chamber or topped its BTC tax chamber could move share prices.

How Bitcoin Driven Micro Strategy’s 453% -Rally

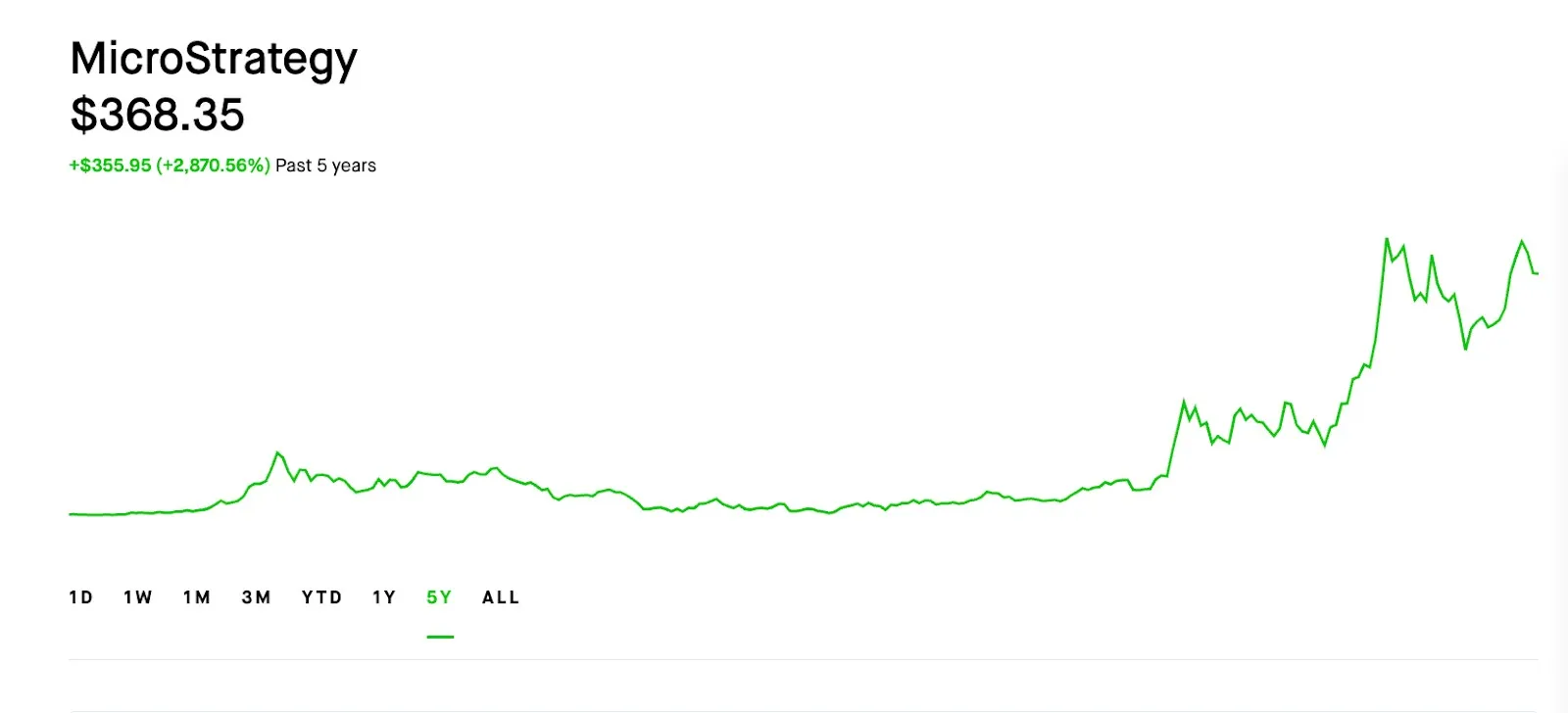

Micro Strategy is the best case and an excellent example of this Treasury-Knäktaging strategy. When they announced their first BTC purchase on August 11, 2020, their share from $ 123.62 jumped to $ 134.89 by day – an increase of 9%.

But it didn’t end there. Each new BTC purchase from the company received more attention from the media, and that attention was translated into more people who bought micro strategy, which created a bit of a flywheel that ultimately led to the micro strategy’s layer sky rocketing, climbed 453% within a year after its first BTC purchase. During the same distance, the price of BTC rose only 306%, which is still impressive, but not as successful as Gain’s Micro Strategy saw during the same period.

To be fair, part of the reason for the micro strategy had so much success to do with timing. When they announced their BTC tax chamber, it was at a time when many accredited investors were still struggling to invest in or obtain exposure to digital currency because of rules Around banks and brokers about crypto assets. For this reason, many accredited institutions realized that they could invest in a listed company with a BTC tax chamber – such as micro strategy – to get exposure to digital assets indirectly. These days, directly crypto Investment opportunities For accredited investors, there are plentiful.

In addition to the unique market position, BTC Treasury was a core of Micro Strategy Business Model, and its founder had a very high conviction in BTC as an asset and was always willing to let it be known. In other words, BTC was not a side game or something that micro strategy just experimented with; It was at the heart of their business strategy, one in which they dumped billions of dollars and just happened to train.

Why BTC Treasuries backfires for some companies

That being said, it is not surprising that other companies are trying to replicate Micro Strategy’s strategy for the BTC state fund. Over the past year, no company has been able to replicate the success of the micro strategy. Actually, many people see the announcement of a BTC tax chamber as having more disadvantages than advantages. When Trump Media and Gamestop recently announced their own BTC state strategies, both companies actually saw their stock prices dip by about 2% the same day.

So what’s the difference? To begin with, micro strategy invests heavily in a persuasive strategy in line with the founder’s identity and beliefs. But for Gamestop and Trump Media, it felt more like a brand movement, a way to appeal to their retail investors while taking hold of media attention that would help the company stay in the headings.

Gamestop and Trump Media also have the issue of scale. For these newer adopters, BTC is just a small piece of their operational strategy. In both cases, their BTC tax chamber did not seem material enough to move the needle. It is starting to look investor Realize that more than they are innovative and bold strategies, they are PR stunts when it comes to BTC state funds. From an investor’s perspective, some may even start considering these BTC Treasury sensations such as “sell the news” events.

Has BTC Treasury Strategy lost its magic?

So, is BTC Treasury Strategy officially played out? I would not say that the strategy is completely played out, but it definitely starts to give declining returns. But that does not mean that the strategy is over.

The future of BTC Treasury Strategy can come to a variable: the price of BTC. If BTC is growing again And companies with BTC Treasuries sees a corresponding hope in the value of the shareholder, we could see another wave of announcements as the media will cover, then set up a chain reaction that can start a hype bike where retail investors are stacked into these shares, which causes prices to increase, get more media attention for its BTC Three BTC Three Btc Three Btc Three Btc Three BTC Three BTC Three BTC Three BTC Three BTC Treasy.

But if BTC drops sharply, as it has done many times before, the strategy can strike back. Companies that increased debt to buy BTC can be left in a position where they do not have funds to repay their lenders. Earlier this year, Micro Strategy reported an unrealized loss of $ 5.91 billion due to a decline in BTC’s price. If a smaller company follows this strategy and gets stuck on the wrong side of a price wing, it can lead to them having to close the store.

This makes me believe that listed companies are on their way. On the one hand, BTC Treasury strategies still offers brand benefits and a chance to fall in favor of a specific demographic of investors and potential business partners. On the other hand, the strategy is starting to look less like an economic feature and more like a marketing gimmick, especially now that it is starting to affect stock prices after announcing.

See: To live the methane to life with Teranode

https://www.youtube.com/watch?v=KDo5ih7gcbs Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard writing; encrypted media; Gyroscope; Image-in-Bild; Web Dividend” Reference Policy = “Strict-Origin-When-Cross-Origin” Allowing Lorscreen = “>”