ETHEREUM-VALUAL SUGGESTIONS LONG SINCE OPTINISM

Ethereum has been in a steep downward trend and lost over 57% of its value since the end of December. Despite brief attempts to recover, ETH continues to fail to recycle decisive price levels and signals additional disadvantages. Ethereum is now shopping for a multi -year support level, which has turned into strong resistance, which makes it even more difficult for bulls to regain speed.

Addition to the negative prospects continues macroeconomic uncertainty and fear of the trade war to weigh both crypto and traditional markets, leading to increased risk-by-feeling among investors. With the American stock market also struggles, Ethereum remains under the press and puts the stage for a potentially deeper correction.

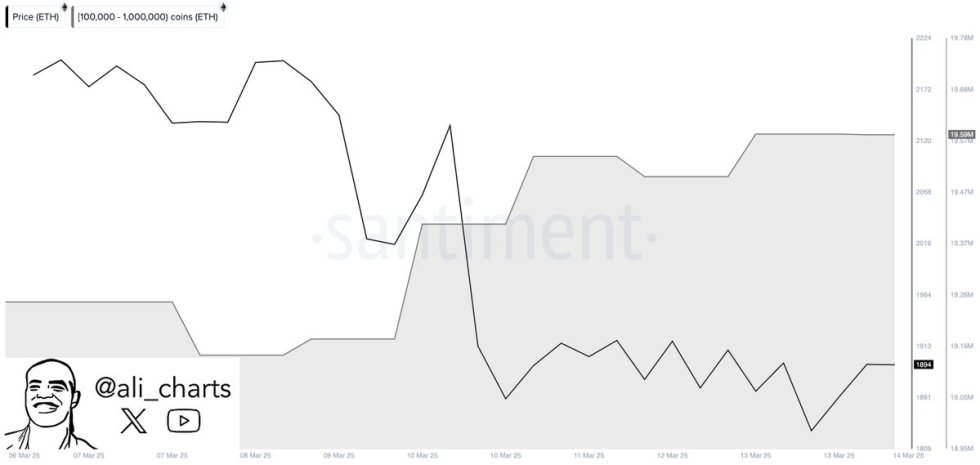

But not all signs are baisse -like. Some analysts believe that Ethereum could recover in the coming months, and data on the chain show potential signs of accumulation. Crypto -analyst Ali Martinez Shared Santiment dataReveals that whales have bought more than 420,000 Ethereum in the last five days.

Historically, large -scale vaulting tends to be a strong long -term haisseatic signal for Ethereum. When whales increase their holdings, it usually proposes growing confidence in ETH’s future price estimate. In previous cycles, ease at low prices has often preceded large rally, as accumulation reduces the available supply on exchanges, which increases the purchase pressure over time.

Related Reading: $ 90,000 appears when Bitcoin Psychological Battleground – Key level dictates marketing terms

At the moment, Ethereum must recover key levels to confirm a trend stool. If whales continue to gather, ETH can set up for a long -term recovery, even if short -term price measures remain volatile.

ETH Bulls struggles to recover key levels

Ethereum is currently traded at $ 1,900, facing continued resistance after days with fighters below the $ 2000 brand. The wider market’s weakness and sales pressure have made it difficult for bulls to regain speed, which leaves ETH vulnerable to further disadvantages if key levels are not recycled soon.

To confirm a recovery, bulls must drive ETH over $ 2,000 and then break through the critical $ 2,250 resistance. Successful recycling of these levels would highlight the beginning of a potential recovery phase, which allows Ethereum to build up for a larger movement upwards.

But if ETH does not recover these levels, sales pressure can be intensified, which drives the price towards lower demand. An interruption under the current support would probably send ETH to the $ 1,700 area, and if Baisseart Momentum persists, a further decline to $ 1,600 can follow.

With the market entry, the next few days will still be crucial to determine whether Ethereum can stabilize and recover or if it will meet deeper corrections. Bulls must soon go in to prevent further disadvantages and regain control of price measures.

Featured Image from Dall-E, Chart from Tradingview