Data shows that Ethereum -Futures volume has turned it from Bitcoin, a sign that strong speculative interest is flooded into the supply.

Ethereum Futures Volume has postponed together with Price Rally

According to the data from the analysis company Glass nodeEthereum has managed to surpass Bitcoin in terms of futures trade volume again. The trade volume here, of course, refers to the amount of trade that a given asset looked at the various centralized stock exchanges on the past day. In connection with the current substance, the volume associated with the futures market is specifically of interest.

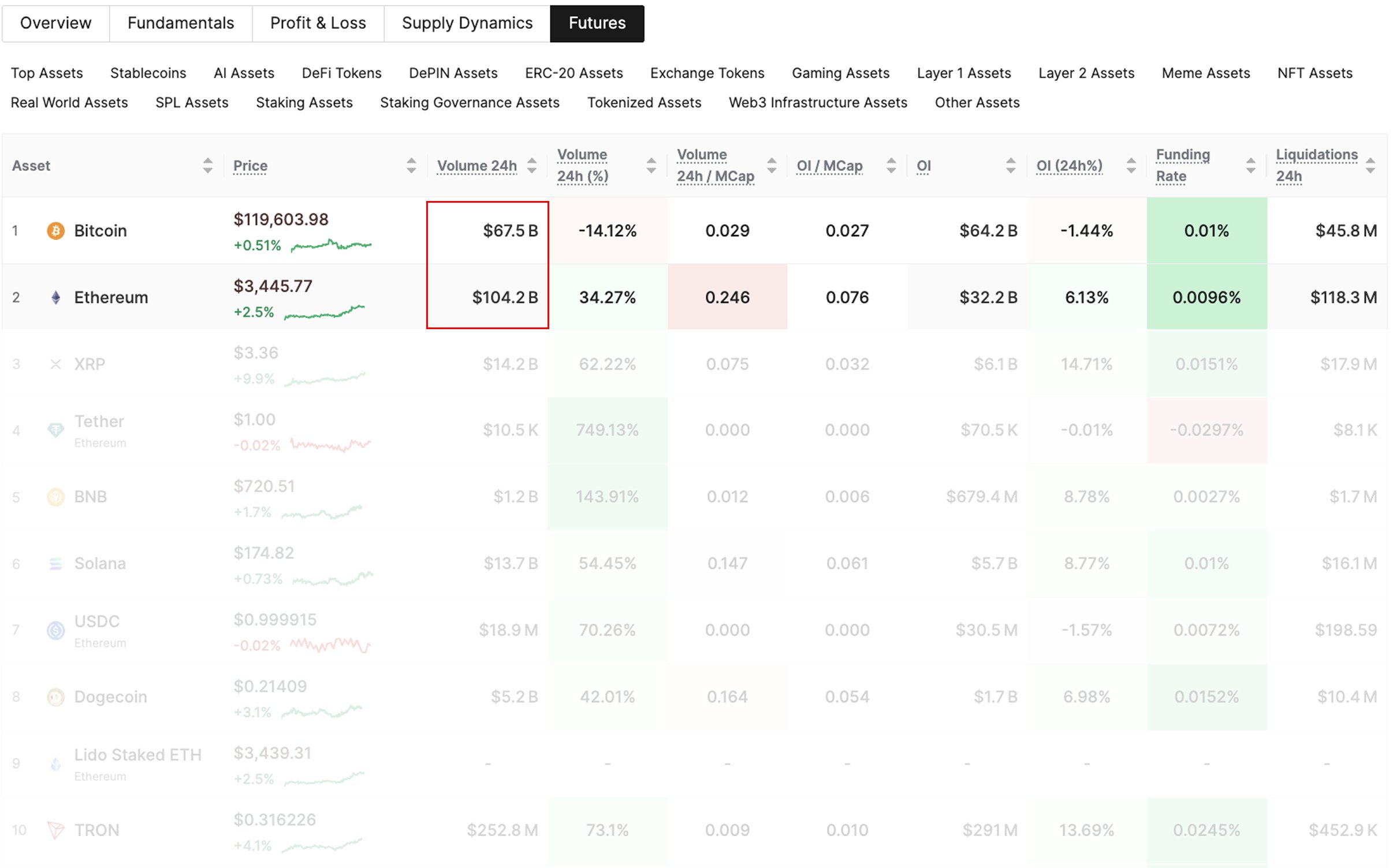

Below is a table showing how this metric compared to Bitcoin and Ethereum at Glassnode’s post.

Looks like the ETH futures volume far outweighs the BTC one | Source: Glassnode on X

As can be seen, Bitcoin registered a futures trade volume of $ 67.5 billion, especially lower than the figure of $ 104.2 billion that Ethereum has seen. This is not something that usually happens, as the main Cryptocurrency usually observes a more speculative demand than ETH or altcoins.

The same table also shows data from some other futures -related indicators. BTC InterestA metric that keeps track of the total amount for futures positions that are currently open on all derivative platforms, set at $ 64.2 billion at the post.

The same indicator for ETH was $ 32.2 billion, indicating that the original digital asset was still far ahead in total market positioning. As I said, the 24-hour change in the Metrics was at positive 6.1% for Ethereum, while Bitcoin saw a reduction of 1.4%

The new demand for ETH has come when the price has broken away from the market, accompanied by a strong wave of inflows to Spot Exchange-Traded Funds (ETFS).

Interestingly, while all this attention came against Cryptocurrency, that is the average The degree of financing Still was not too positive. The financing rate is an indicator that keeps track of the amount of periodic fees that traders in the futures market exchange between each other.

When this metric is green, it means that the long investors pay a premium to the short ones to hold on to their positions. Such a trend involves the presence of a raisy mentality among the traders.

From the table it is obvious that the financing rate was 0.0096% for Ethereum even after the top of futures trade volume. This was less than Bitcoin’s value of 0.01%. Although new positioning occurs for ETH, it seems that investors are still not too optimistic.

“This attitude is leaning on Hausse: strong speculative interest, rising OI and no signs of overheating yet,” the analysis company notes.

Tet price

At the time of writing, Ethereum is traded with about $ 3,600, an increase of almost 21% over the past week.

The price of the coin has surged during the past few days | Source: ETHUSDT on TradingView

Image from Dall-E, Glassnode.com, diagram from tradingview.com

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.