- BTC has been stuck within $ 80k- $ 85K interval for a while.

- Analysts remained cautious despite the hopes of a potential Feds dovish slope.

On Tuesday Bitcoin (BTC) triggered another seizure of crypto market sales after dipping to $ 81,000 from $ 84K and closed the daily session with a loss of 1.54%.

It was the first day of FOMC (Federal Open Market Committee), and analysts also linked sales to geopolitical tensions.

According to the Crypto Options Trading Desk QCP Capital, renewed voltages in the Middle East sales. Part of their daily market report readThe

“In the absence of new customs headlines, geopolitics has returned to the forefront.

What is the next post-Fomc?

The BTC decline saw Top Altcoins -Posten varied Retracenter. Solana (sun) Tapped 5% but closed the session by only 2%. XRP Also published a loss of 2.2% on Tuesday, similar to Ada.

Only Ethereum (ETH) Stabilized with a 0.27% gain during the trading period.

On the contrary, Them (them) and Hyperliquid (hype) Was top performance with 17% and 7% profits during the same period.

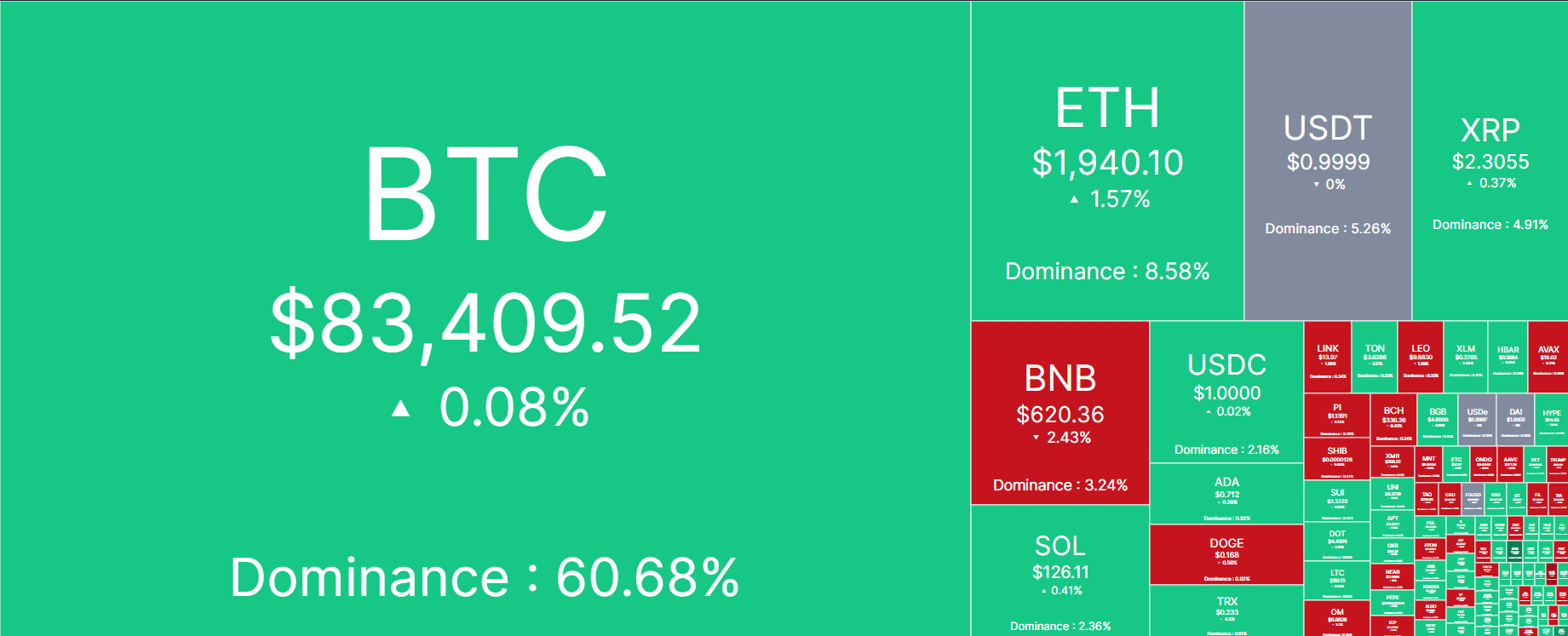

At press time BTC recovered $ 83K, while ETH was over $ 1.9,000 a few hours before the FOMC Consultation. But Binance Coin (BNB) and Dogecoin (Doge) Had still held sales from this writing.

Whether the Fed Rate decision will drive crypto recovery or extend the decline remains to be seen.

That said, Jake Ostrovskis, an OTC (without a counter) trader on Wintermute, noted That BTC and Crypto would remain covered in view of their positive correlation with risks for US shares than gold.

“With correlations with the former (Nasdaq), the market will fight to be higher without being led by wider risk.

Swissblock Blockchain Analytics Firm for its part Repeated that the market was in a “high -risk” state and the neck risk could not be overridden.

The risk-off feeling was confirmed by Crypto Fear and Greed Index, which was on ‘fear‘Levels of 32. While this may be a’buy’ Opportunity for long -term investors, Fed Policy Outlook can offer clues for such a move.

Meanwhile, QCP Capital warned that President Trump’s new Customs Round planned until April 2 could be key data to look at after the Fed meeting. The abandonedThe

“BTC of $ 80k: A real floor or a mirage?