Key dealers

- XRP’s price increased by 10% to $ 2.6 and past USDT as the third largest crypto supply.

- Ripple expands its institutional presence through acquisitions and strategic partnerships.

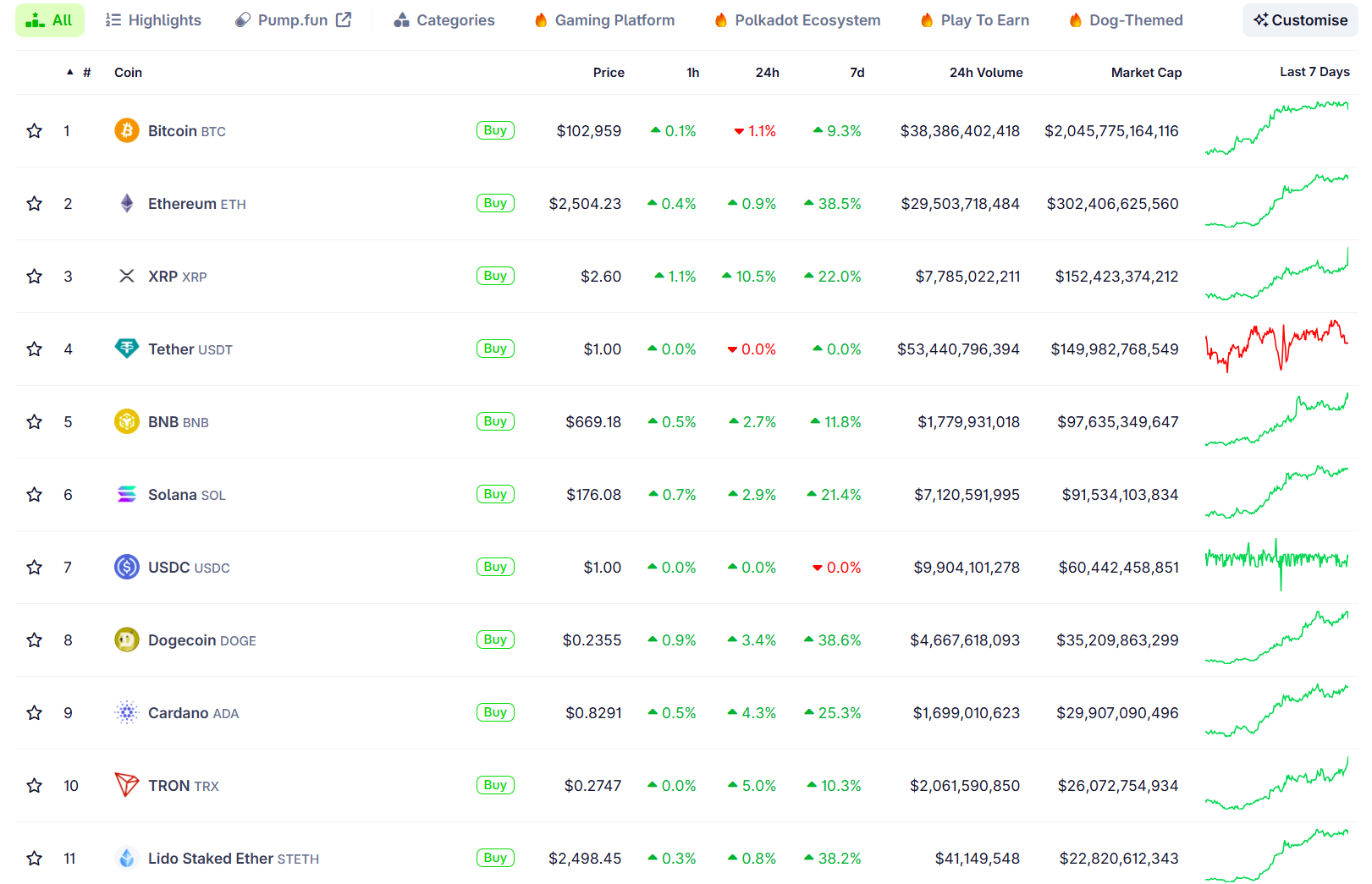

XRP has increased by 10% over the past 24 hours to reach $ 2.6, and lift its market value to approximately $ 152 billion and recycle its position as the third largest crypto asset, coytecko data shows.

The over -voltage pressed a narrow Ripples flagship currency before Tether’s USDT, which also achieved a large milestone. USDT’s market value hit $ 150 billion for the first time on Monday and cemented its role as the leading and most used Stablecoin in the crypto ecosystem.

XRP is now on its highest level since the beginning of March, although digital asset remains about 24% during its maximum time of $ 3.4, which was set in January 2018.

This is not the first time XRP has climbed to the third place in the market ranking. In December last year, the crypto asset reached a market capitalization on Over $ 140 billionOparts Tether and Solana to become the third largest Cryptocurrency by market value.

At that time, the rally was driven by optimism over an American election result that is seen as favorable for local crypto -initiatives, along with speculative interest in the potential approval of Spot XRP ETFs.

The same catalysts have once again reigned Hausseartat Momentum. Last Friday Ripple and Sec announced a joint movement To resolve its year -long legal dispute for $ 50 million.

The agreement, in anticipation of the court’s approval, would allow Ripple to recover $ 125 million currently held in Escrow, at the same time as the Court’s preliminary ruling for XRP sales.

Apart from its ongoing attempts to solve the case, Ripple has also made headlines for its latest pressure to expand its footprint in institutional financing and the StableCoin market.

In April, the company reached an agreement on Acquire Hidden RoadA primary broker with multiple assets, for $ 1.25 billion. The acquisition aims to strengthen Ripple’s offers for financial services, with hidden road planning to transfer their activities after trading to the XRP book.

Also last month, ripple reportedly made a bid Between $ 4 billion and $ 5 billion to acquire Circle, USDC Stablecoin issuer. However, the offer was in the end of Circle, which considered the valuation undervalued in the light of its upcoming stock exchange listing.